Morningstar data shows that market conditions didn’t turn investors away from bonds in 2021 with Treasury inflation-protected securities (TIPS) and short duration getting attention.

“Even as inflation rose and bond returns turned negative, investors poured more money than ever into taxable-bond funds,” Morningstar notes. “Similarly, political risk and economic concerns didn’t deter investors from international equity funds. Both broad category groups recorded more inflows than in any year since Morningstar started tracking fund flow data in 1993.”

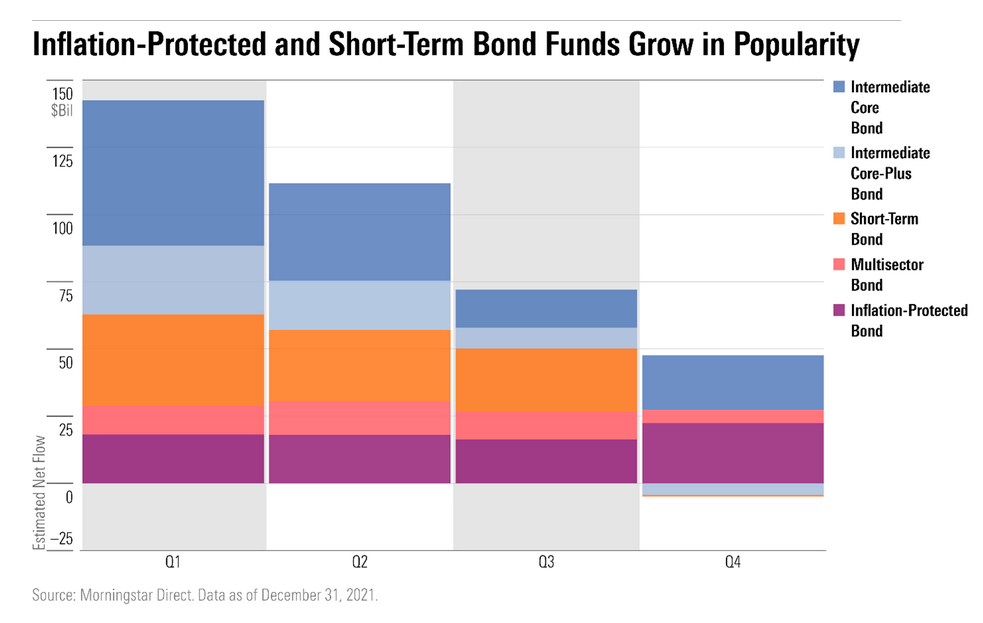

Intermediate bond funds got the majority of flows, but investors were also quick to note that inflation protection would be a necessity moving forward. As the economy started to recover and the prospect of rate increases were looking more likely, investors’ behavior reflected that notion.

“Intermediate-core bonds still garnered the most money, but short-term and inflation-protected bond funds took a large share of investors’ dollars this year,” Morningstar adds. “Short-term bond funds were extremely popular in the start of the year. As inflation jumped, investors put more and more into inflation-protected bond funds. The amount of money in these funds grew by 35%.”

Two Options to Consider

To get short-term duration amid rate increases while also limiting the impact of tighter monetary policy courtesy of the Fed, investors can look at the Vanguard Short-Term Inflation-Protected Securities Index Fund ETF Shares (VTIP). The fund comes with a low expense ratio of just 0.05%.

VTIP seeks to track the Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) 0-5 Year Index performance. The index is a market capitalization-weighted index that includes all inflation-protected public obligations issued by the U.S. Treasury with remaining maturities of less than five years.

The manager attempts to replicate the target index by investing all, or substantially all, of its assets in the securities that make up the index, holding each security in approximately the same proportion as its weighting in the index.

To shorten duration even further to maturity dates that don’t exceed three years, there’s the Vanguard Short-Term Treasury ETF (VGSH). The fund also comes with a low 0.04% expense ratio.

With short duration in focus, VGSH is a prime option to consider. This ETF offers exposure to short-term government bonds, focusing on Treasury bonds that mature in one to three years.

It’s an ideal option, given the uncertainty in the current market environment. Bonds can offer investors a safe haven against stock market volatility, while short-term bonds limit the risks of potential rate rises that can rob investors of fixed income opportunities.

For more news, information, and strategy, visit the Fixed Income Channel.