In addition to fund flows, volume is also an indicator of heightened activity for some exchange traded funds (ETFs) to gauge where investors are allocating their capital. That’s evident in certain bond ETFs from Vanguard.

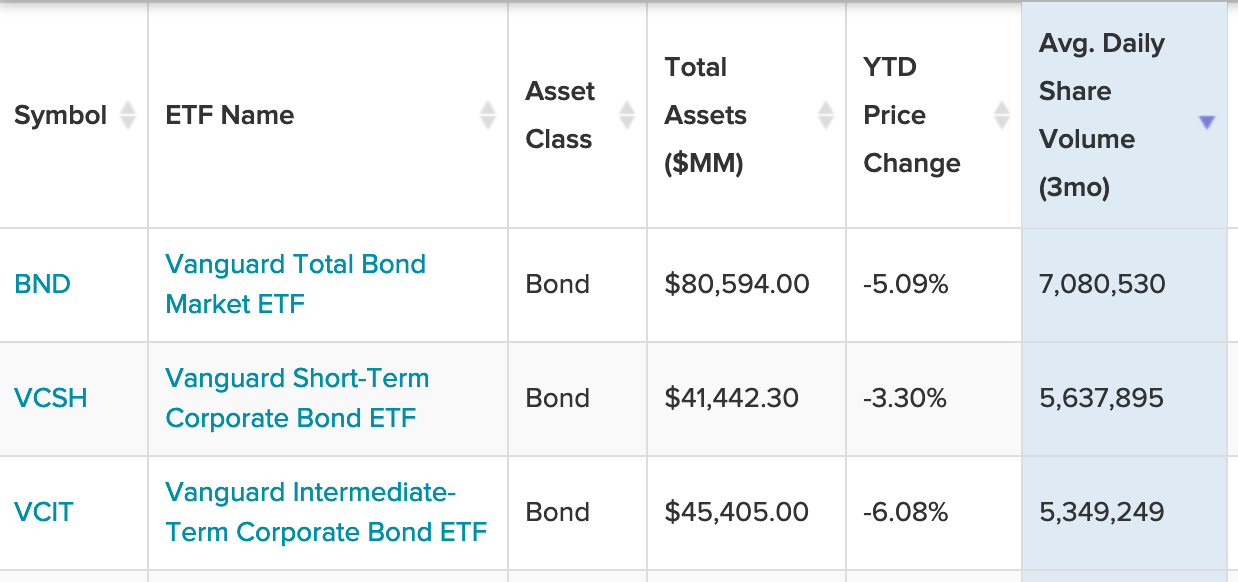

In terms of average daily share volume for the year, at the top of the list is the Vanguard Total Bond Market Index Fund ETF Shares (BND). Despite bonds correlating with equities lately, they still serve as a safe haven option, especially amid the geopolitical tensions in Ukraine.

BND is an aggregate bond option that seeks to match the Bloomberg U.S. Aggregate Float Adjusted Index. The index includes a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than a year.

Limiting Duration Amid Rising Rates

Next highest in terms of volume is the Vanguard Short-Term Corporate Bond Index Fund ETF Shares (VCSH). With the U.S. Federal Reserve hiking the federal funds rate by 25 basis points recently, more is expected to come as inflation continues to run hot.

As such, limiting duration is ideal with a fund like VCSH, which seeks to track the performance of a market-weighted corporate bond index with a short-term dollar-weighted average maturity. The fund employs an indexing investment approach designed to track the performance of the Bloomberg U.S. 1-5 Year Corporate Bond Index.

This index includes U.S. dollar-denominated, investment-grade, fixed-rate, taxable securities issued by industrial, utility, and financial companies, with maturities between one and five years. Under normal circumstances, at least 80% of the fund’s assets will be invested in bonds included in the index.

For bond investors seeking more yield, there’s the Vanguard Interim-Term Corporate Bond ETF (VCIT).

Corporate bonds can give bond investors more yield, albeit more risk, so if anything beyond a 10-year maturity doesn’t fit in an investor’s risk profile, VCIT is ideal for this type of targeted exposure. Furthermore, VCIT presents a viable option for investors who still want to obtain higher yields that short-duration bonds can’t offer.

Overall, the fund seeks to track the performance of a market-weighted corporate bond index with an intermediate-term dollar-weighted average maturity. The fund employs an indexing investment approach designed to track the performance of the Bloomberg U.S. 5–10 Year Corporate Bond Index, which includes U.S. dollar-denominated, investment-grade, fixed-rate, taxable securities issued by industrial, utility, and financial companies, with maturities between five and 10 years.

For more news, information, and strategy, visit the Fixed Income Channel.