By Jack Forehand

It is commonly accepted that beating the stock market over the long-term is really difficult. Over the past 15 years, about 70% of large-cap managers have trailed the S&P 500 and about 80% of small-cap managers have trailed the Russell 2000.

Investors in these funds have done significantly worse than that. The so-called behavior gap, which measures the difference between a fund’s performance and the performance of investors within the fund, is typically significantly wider for active funds than their index counterparts. This is caused by the fact that active funds introduce more opportunities for bad behavior. With index funds, investors tend to panic when the market is down and sell, which leads to poor performance relative to the funds they are invested in, but with active funds, investors also tend to panic when the fund is underperforming its benchmark, which leads to even worse investor returns.

Related: The Potential Impact of Sales Tax on Internet Sales

Despite the extensive research that is available on this subject, investors continue to make the same mistakes and continue to be unwilling to sit though the periods of underperformance that are required to successfully implement an active strategy. From my experience, this is in part due to the fact that investors continue to expect consistent short-term results from strategies that aren’t setup to and can’t provide them.

This is in part due to our human nature, but also in part due to the narrative that there are managers who have accomplished this historically. For instance, Bill Miller was known as “the man who beats the market” for his 15 calendar year streak of beating the S&P 500, but behind that calendar year streak were many twelve month periods that he did not beat the market. A big part of his streak was luck due to when the calendar year begins and ends.

Miller himself admitted that. He said the following about the streak.

“As for the so-called streak, that’s an accident of the calendar. If the year ended on different months it wouldn’t be there and at some point the mathematics will hit us. We’ve been lucky. Well, maybe it’s not 100% luck—maybe 95% luck.”

Miller also went on to suffer an extended period of underperformance following the streak (which he has since bounced back from).

To illustrate just how difficult it is (read: impossible) to beat the market every year, I thought it would be interesting to take a look at the performance of the active strategies we follow over the past decade to see if even with the benefit of perfect hindsight, I could develop a strategy that would exhibit that kind of consistency.

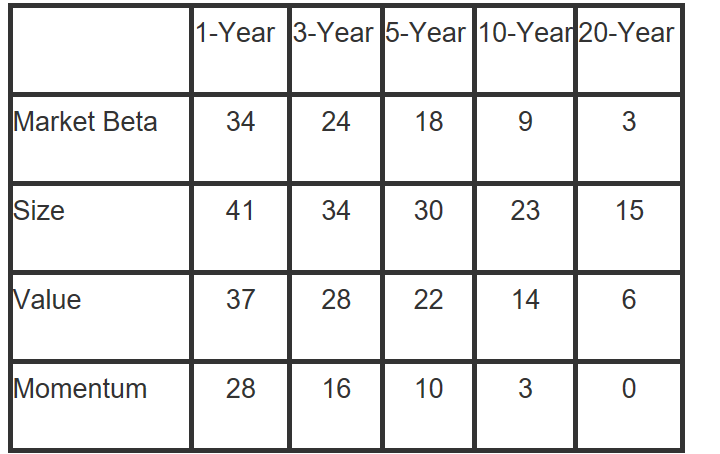

But first let’s establish a baseline. The chart below is from an excellent article by Larry Swedroe on the value premium. In the article, he looks at data from 1927 to the present and examines the chances that factor strategies will underperform in specific periods. Over a one-year period, he finds that all factors underperform at least 28 percent of the time. The chart confirms that sitting through periods of underperformance is the price you have to pay to generate outperformance with factor strategies over time.

![]()

https://www.advisorperspectives.com/articles/2018/06/14/in-defense-of-the-value-premium?channel=ETF

Using the factor-based strategies we run, I took a look at whether it is possible to eliminate this risk, even under perfect circumstances.