Getting extra yield in the current market landscape requires investors to take on more risk. One option is to head for overseas markets with ETFs like the Vanguard International Dividend Appreciation Index Fund ETF Shares (VIGI).

option for fixed income investors where max yields domestically might not be available.

“With interest rates in the U.S. and other primary developed economies still at relatively low levels, many investors looking to diversify their portfolios internationally seek the added benefit of higher dividend yields available abroad,” an Investopedia article explained. “There are a number of exchange-traded funds (ETFs) available in the category of international equity funds that offer dividend yields in excess of 5%.”

As such, VIGI seeks to track the performance of Nasdaq International Dividend Achievers Select Index that measures the investment return of non-U.S. companies that have a history of increasing dividends. The index focuses on high-quality companies located in developed and emerging markets, excluding the U.S., that have both the ability and the commitment to grow their dividends over time.

Furthermore, the manager attempts to replicate the target index by investing all, or substantially all, of its assets in the broadly diversified collection of securities that make up the index, holding each stock in approximately the same proportion as its weighting in the index. VIGI also comes with a low expense ratio of 0.20%.

VIGI:

- Seeks to track the performance of the NASDAQ International Dividend Achievers Select Index.

- Provides a convenient way to get exposure across developed and emerging non-U.S. equity securities around the world that have a history of increasing dividends

- Employs a passively managed, full-replication strategy.

International Debt Diversification

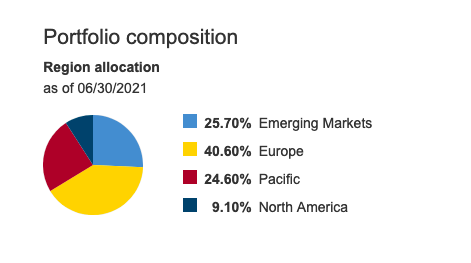

While VIGI does give fixed income investors North American exposure, it only comprises around 9% of the fund. The rest of the exposure focuses primarily on European, Pacific, and emerging debt markets.

Overall, it gives broad international exposure to dividends that have high growth potential.

“International dividend ETFs work much like their domestic high dividend counterparts; they simply invest in international companies instead of those based in the U.S.,” a Forbes article explained. “This kind of international exposure can further diversify your portfolio.”

For more news, information, and strategy, visit the Fixed Income Channel.