In order to extract maximum yield out of safe haven Treasury notes, fixed income investors must be willing to step far out into the long end of the yield curve with funds like the inexpensive Vanguard Long-Term Treasury Index Fund ETF Shares (VGLT).

With its paltry expense ratio of just 0.05%, cost-conscious fixed income investors have the fund they’re looking for in VGLT.

VGLT seeks to track the performance of a market-weighted Treasury index with a long-term dollar-weighted average maturity. The fund employs an indexing investment approach designed to track the performance of the Bloomberg Barclays U.S. Long Treasury Bond Index.

This index includes fixed income securities issued by the U.S. Treasury (not including inflation-protected bonds), with maturities greater than 10 years. Under normal circumstances, at least 80% of the fund’s assets will be invested in bonds included in the index.

“This ETF offers exposure to long term government bonds, focusing on Treasuries that mature in ten years or more,” an ETF Database analysis said. “As such, interest rate exposure for this product will be towards the high end, potentially creating an attractive yield profile.”

The analysis also mentioned that the fund “can be a useful tool for tilting exposure towards Treasuries with a bias towards the longer end of the maturity spectrum, lengthening the effective duration of a portfolio and potentially boosting the yield without taking on much in the way of credit risk. Like most Vanguard ETFs, VGLT is among the cheapest options available; commission free trading in Vanguard accounts may increase the cost appeal to those keeping an eye on fees.”

VGLT:

- Seeks to provide a high and sustainable level of current income.

- Invests primarily in U.S. Treasury bonds.

- Maintains a dollar-weighted average maturity of 10 to 25 years.

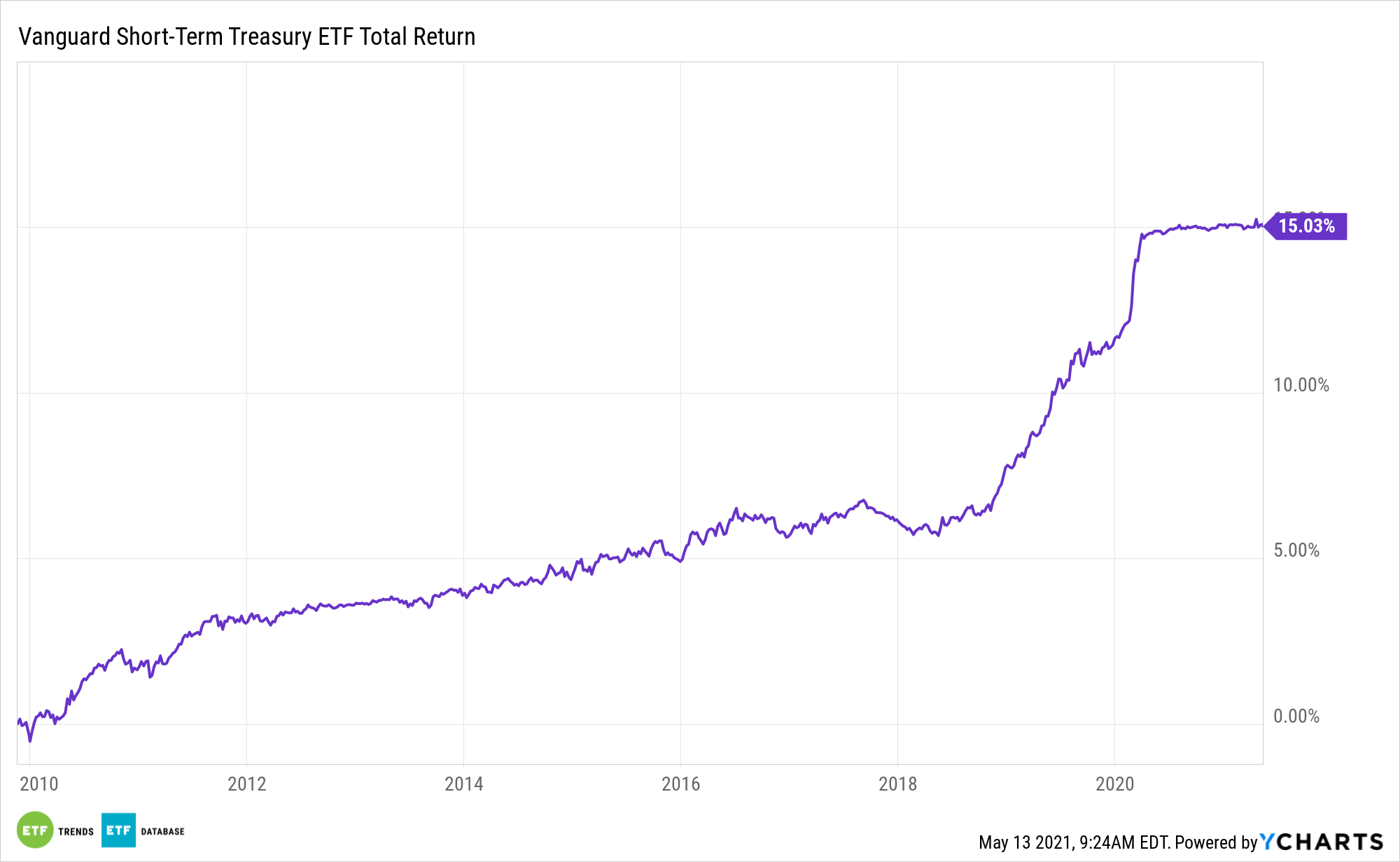

A Short-Term Option for Inflation Jitters

For investors who are feeling the inflation jitters, Vanguard also offers a short-term option. With its focus on the short end of the yield curve, the Vanguard Short-Term Treasury Index Fund ETF Shares (VGSH) minimizes inflation risk.

VGSH seeks to track the performance of a market-weighted Treasury index with a short-term dollar-weighted average maturity. The fund employs an indexing investment approach designed to track the performance of the Bloomberg Barclays US Treasury 1-3 Year Bond Index.

This index includes fixed income securities issued by the U.S. Treasury (not including inflation-protected securities), all with maturities between 1 and 3 years. At least 80% of the fund’s assets will be invested in bonds included in the index.

For more news, information, and strategy, visit the Fixed Income Channel.