The U.S. municipal bond market represents a $3.8 trillion pie and smart beta exchange-traded fund (ETF) strategies are looking for a slice as Columbia Threadneedle Investments has filed for an ETF dubbed the Columbia Multi-Sector Municipal Income ETF that will incorporate rules-based and strategic beta strategies.

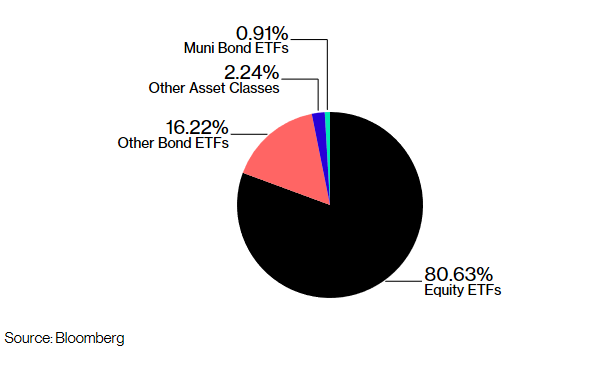

Columbia already boasts an ETF roster that utilizes smart beta strategies for emerging markets, equity income and fixed income. However, the municipal bond market has been relatively untouched as shown in the pie chart below.

![]()

However, once Columbia sets its footprint on the municipal bond market, other ETFs using smart beta strategies are likely to follow, according to Marc Zeitoun, head of strategic beta at Columbia Threadneedle. By his estimation, the shift to benchmarking and passive investing in the municipal bond market is trailing the equity market by about six years.

“This is a trend that will likely occur in the municipal world,” said Zeitoun. “It’s happening in every other asset class.

Columbia’s foray into a municipal bond market that typically relies on passive investment strategies will be a first in terms of using a smart beta strategy. These strategies can include multi-factor investments that help combine uncorrelated investment styles to smooth out volatility.