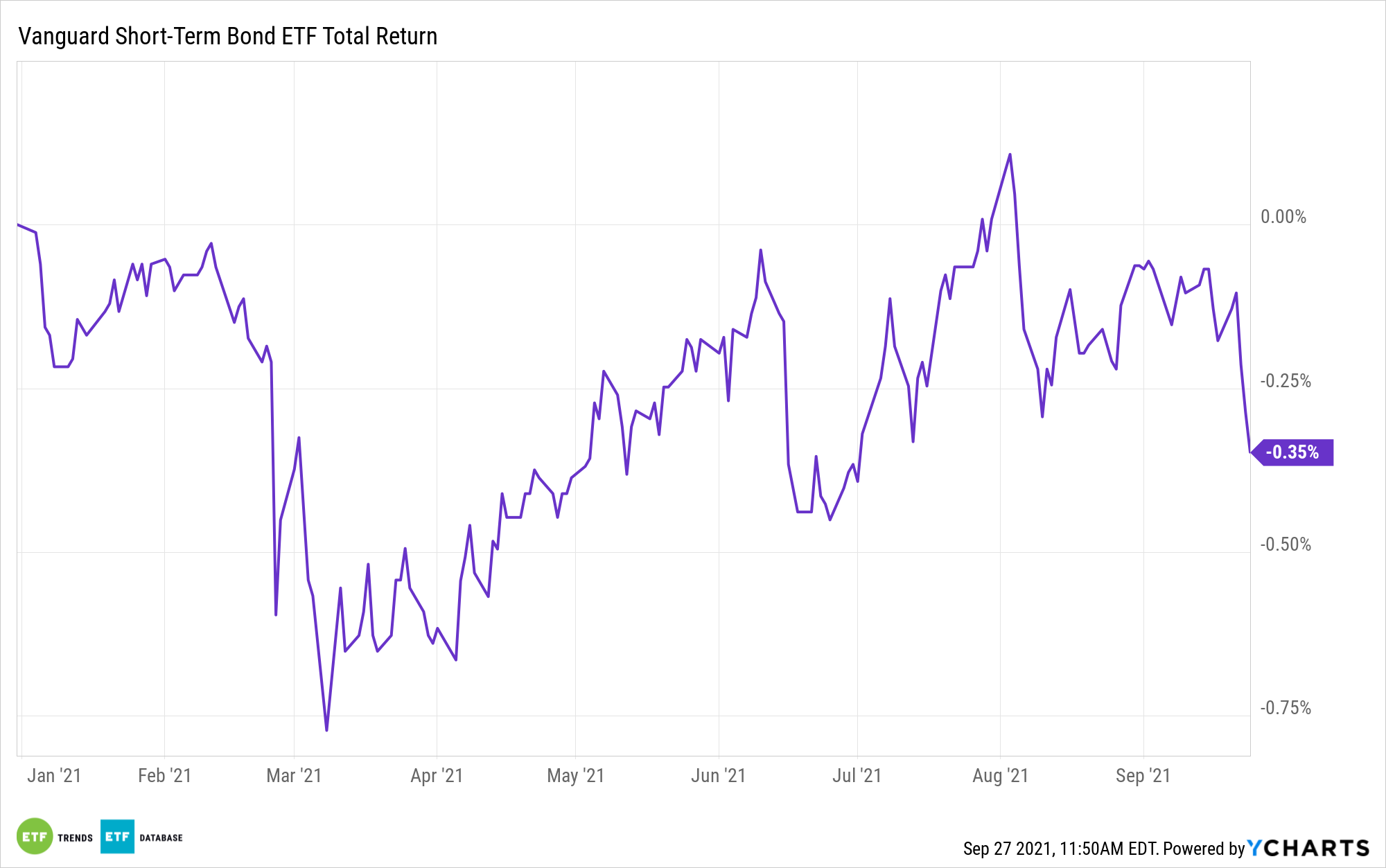

Amid the wild swings in the stock market last week, one market occurrence going on quietly in the background was rising yields. If the trend persists, getting shorter duration could help stem the tide with the Vanguard Short-Term Bond Index Fund ETF Shares (BSV).

If the latest moves suggest more yields in the short-term, BSV presents fixed income investors with a prime option.

“Bond yields have been on a mini-surge this week,” a Barron’s article said. “The current yield on the 10-year Treasury suggests it can rise even more in the short-term, making cyclical stocks look like good bets.”

“The 10-year yield rose to 1.46% on Friday from a low point of 1.3% this week,” the article added. “It passed 1.38% this week, a key level of support at which buyers had tended to step in for the past few months. Bond prices and yields move inversely.”

BSV seeks to track the performance of the Bloomberg U.S. 1–5 Year Government/Credit Float Adjusted Index. This index includes a diverse array of bond exposures, including all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities between one and five years and are publicly issued.

Highlights of BSV:

- Seeks to track the performance of the Bloomberg U.S. 1–5 Year Government/Credit Float Adjusted Index, a market-weighted bond index that covers investment-grade bonds with a dollar-weighted average maturity of one to five years.

- Invests in U.S. government, high-quality (investment-grade) corporate and investment-grade international dollar-denominated bonds.

- Follows a passively managed, index sampling approach.

Rate Hikes Forthcoming

The Federal Reserve recently acknowledged that the economy is showing signs of life that could portend interest rate hikes in 2022. Investors can use funds like BSV to brace themselves for the new year once 2021 comes to a close.

“The job market has improved, inflation is running hot, and supply chain constraints are persisting,” said Mike Fratantoni, Mortgage Bankers Association’s (MBA) senior vice president and chief economist. “As a result, it is not surprising that the Fed will begin to remove accommodation. The biggest news out of this meeting was the change in FOMC projections, with most members now seeing a first interest rate hike in 2022, which is faster than many market participants had previously anticipated.”

For more news, information, and strategy, visit the Fixed Income Channel.