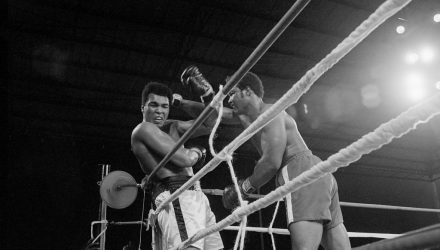

In 1974, Muhammad Ali coined one of his famous phrases “Float like a butterfly, sting like a bee – his hands can’t hit what his eyes can’t see,” with reference to his prizefighting ability before his upcoming bout with then-undefeated boxer George Foreman at “The Rumble in the Jungle.” Fixed-income investors can apply this mentality to the current economic landscape where the propensity for rate hikes by the Federal Reserve can tamp down income provided by bonds–unless investors hit back with fixed-income investments that feature a floating rate component.

Rather than invest directly in the bonds themselves, investors can opt for an exchange-trade fund that invests in loans that feature floating rates like the SPDR Blackstone/GSO Senior Loan Portfolio (NYSEArca: SRLN). The Federal Reserve is likely to remain hawkish, particularly after the latest economic data showed that gross domestic product grew by 4.1%, but floating rates that move in conjunction with short-term adjustments by the Federal Reserve provide the elusive defense that Ali would even admire–other than his own.

Related: ‘A Lot Has to Change’ to Reach 5% Treasury Yield

Furthermore, SRLN invests in senior loans given to businesses operating in North America and outside of North America. The Portfolio may invest in senior loans through the loans directly via the primary or secondary market or via participations in senior loans, which are contractual relationships with an existing lender in a loan facility where the loan portfolio purchases the right to receive principal and interest payments.

By including senior loans in SRLN’s portfolio, the loans first lien priority, meaning in the event of a borrower default, the senior loans are paid first. Higher payment priority assists liquidity in terms of the defaulting borrower having to sell assets in order to pay off creditors–in this case, senior loans within the SRLN portfolio are given higher priority–a viable option especially during a market downturn.