“Floating-rate assets like senior secured loans have produced consistent income through various interest rate cycles, and may help investors build a more-resilient fixed-income portfolio as the current investment environment evolves,” noted Michael Terwilliger, CFA, contributor at Wealthmanagement.com. “So as rates continue to rise, and fixed-income investors face increased challenges, senior secured loans may provide an alternative income solution with downside protection.”

All assets under the fund are funneled into the Blackstone / GSO Senior Loan Portfolio, and SRLN’s main objective is to outperform a primary and secondary index–the Markit iBoxx USD Liquid Leveraged Loan Index and the S&P/LSTA U.S. Leveraged Loan 100 Index through its investment in senior loans.

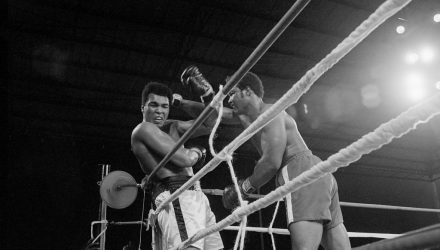

With all signs pointing to a robust economy, it sets the stage for Federal Reserve Chairman Jerome Powell to announce more interest rate hikes in September in addition to the pair of rate hikes already seen this year. However, with the right strategies like investing in ETFs with a floating rate component, fixed-income investors won’t find themselves against the ropes.

For more trends in fixed income, visit the Rising Rates Channel.