Related: Multifactor ETFs Great Investment

Low volatility’s relative outperformance wasn’t just contained to large-cap stocks. The S&P 400 MidCap Low Volatility Index outpaced the S&P MidCap 400 Index by roughly 3% during the quarter, while the S&P 600 SmallCap Low Volatility Index was marginally stronger than the S&P SmallCap 600 Index.

![]()

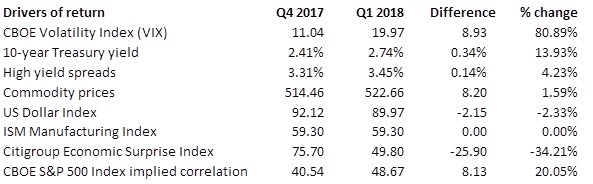

Source: Bloomberg, L.P. as of March 31, 2018. Commodity prices represented by CRB BLS Spot Index. High yield spreads defined by the Barcap US Corporate High Yield to Worst-10 year Treasury Spread Index

Looking ahead

Looking ahead, I believe low volatility strategies could provide a path for diversifying risk and reducing concentration risk present in market-cap-weighted indexes and momentum strategies. Despite recent market volatility, the underlying strength of the US economy and expected profit growth within the information technology sector are both positives for the momentum factor, and may play against technology’s inherent risks. Moreover, investors are still digesting quarterly earnings results. With the bar to beat earnings estimates set low, we could see upside surprises.

I believe the outlook for technology companies remains bright. Based on consensus earnings estimates, the S&P 500 technology sector could see growth in excess of 26% in 2018. That’s potentially significant, as technology accounts for nearly 40% of the S&P 500 Momentum Index and nearly one quarter of the S&P 500 Index.

More specifically, Apple, Microsoft, Facebook, Alphabet, Amazon and Intel account for 14.8% of the S&P 500 Index, while Microsoft, Facebook, Alphabet, and Amazon account for 24.5% of the S&P 500 Momentum Index.

Importantly, the S&P 500 Low Volatility Index holds none of these names. For that reason, a low volatility strategy could potentially provide a different return and risk profile and may generate diversification benefits when combined with either the S&P 500 Index or a momentum strategy.

This article was republished with permission from Invesco Powershares.