U.S. municipal bonds represent a $3.8 trillion slice of an even bigger bond market pie and investors should consider the local government debt space as volatility continues to rain down on the capital markets.

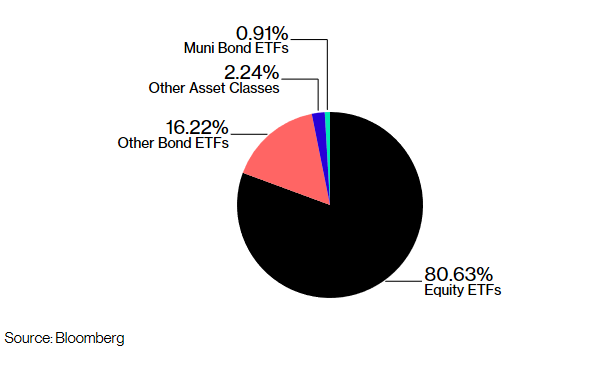

One way for investors to get exposure to municipal bonds and thus, get slice of the muni bond pie, is via exchange-traded funds (ETFs) that focus on these debt issues. In short, municipal bond ETFs focus on the debt of municipalities, such as cities or towns.

![]()

ETF offerings in the muni bond market include the iShares National Municipal Bond ETF (NYSEArca: MUB), SPDR Nuveen Bloomberg Barclays ST Municipal Bond ETF (NYSEArca: SHM) and the Vanguard Tax-Exempt Bond ETF (NYSEArca: VTEB).

“Historically, gaining access to municipal bonds through an index strategy has been difficult because the muni bond market is much more fragmented and expensive to trade than other fixed-income markets,” said Daniel Sotiroff of Morningstar. “But process improvements over the past several years, combined with a deeper knowledge of the market, have provided asset management firms like Vanguard with an advantage.”

In the video below, Sean Carney, head of municipal strategy and primary markets at BlackRock, discusses record high valuations in the municipal bond market. He speaks with Bloomberg’s Taylor Riggs in this week’s “Muni Moment” on “Bloomberg Markets.”

For more market trends, visit ETF Trends