However, as an active manager, we have the flexibility to avoid these large structures as we evaluate credit risk relative to the value. So while the large issues/issuers are often part of the indexes and products that track them, we don’t have to include them in our strategy.

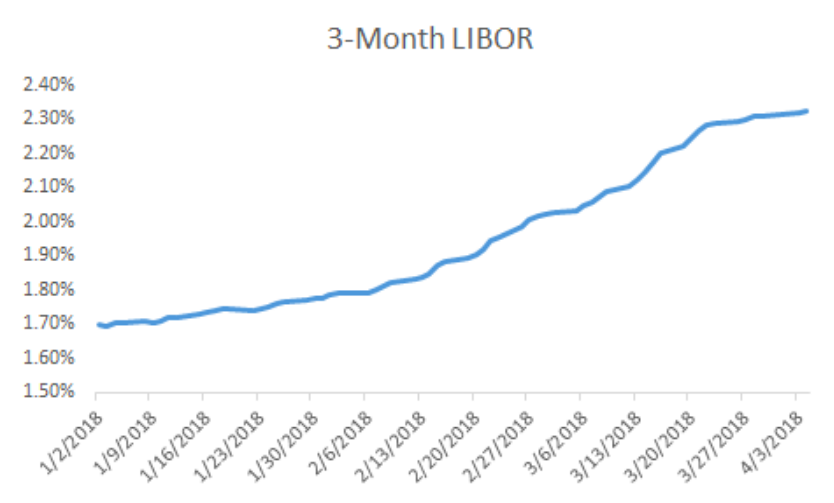

Flexibility in our active strategy is also providing us another benefit right now. We have the ability to include floating rate loans as we look to invest in high yield debt. These loans are tied to LIBOR and their rates generally reset every one to three months. While the 10-year Treasury yield did see a jump earlier this year and has since largely leveled out, we have seen and continue to see a steady and significant move up in LIBOR.(4)

![]()

This in turn can led to higher yields/rates on floating rate loans, with the caveat that we’ve seen a massive wave of repricings over the last year, including these first few months of 2018.

With the wave of repricings seen in the broader loan market, much of that LIBOR benefit is being eaten up by the lower spreads that generally come as part of the repricings of these loans.

With our flexibility as to what we own in the loan space, versus tracking an index that often again focuses on the largest loans outstanding for the passive loan products, we can selectively find loans that are not subject to repricings and where we see the yield benefit from the rising LIBOR rate playing out. We believe this sort of flexibility creates the opportunity for active managers in high yield debt as they work to generate alpha versus their passive counterparts.

With our own active strategy, we continue to focus on value relative to risk in both the high yield bond and loan market as we work to generate steady income with the potential for capital appreciation.

- Acciavatti, Peter D., Tony Linares, Nelson R. Jantzen, CFA, Rahul Sharma, and Chuanxin Li, “Default Monitor,” J.P. Morgan, North American High Yield and Leveraged Loan Research, April 2, 2018, p. 2, https://markets.jpmorgan.com.

- Acciavatti, Peter D., Tony Linares, Nelson R. Jantzen, CFA, Rahul Sharma, and Chuanxin Li, “Default Monitor,” J.P. Morgan, North American High Yield and Leveraged Loan Research, April 2, 2018, p. 2, https://markets.jpmorgan.com.

- Acciavatti, Peter D., Tony Linares, Nelson R. Jantzen, CFA, Rahul Sharma, and Chuanxin Li, “Default Monitor,” J.P. Morgan, North American High Yield and Leveraged Loan Research, April 2, 2018, p. 3, https://markets.jpmorgan.com.

- Based on the 3 month LIBOR rates for the period 1/1/18 to 4/4/18. Data sourced from Bloomberg.

Although information and analysis contained herein has been obtained from sources Peritus I Asset Management, LLC believes to be reliable, its accuracy and completeness cannot be guaranteed. This report is for informational purposes only. Any recommendation made in this report may not be suitable for all investors. As with all investments, investing in high yield corporate bonds and loans and other fixed income, equity, and fund securities involves various risks and uncertainties, as well as the potential for loss. High yield bonds are lower rated bonds and involve a greater degree of risk versus investment grade bonds in return for the higher yield potential. As such, securities rated below investment grade generally entail greater credit, market, issuer, and liquidity risk than investment grade securities. Interest rate risk may also occur when interest rates rise. Past performance is not an indication or guarantee of future results. The index returns and other statistics are provided for purposes of comparison and information, however an investment cannot be made in an index.