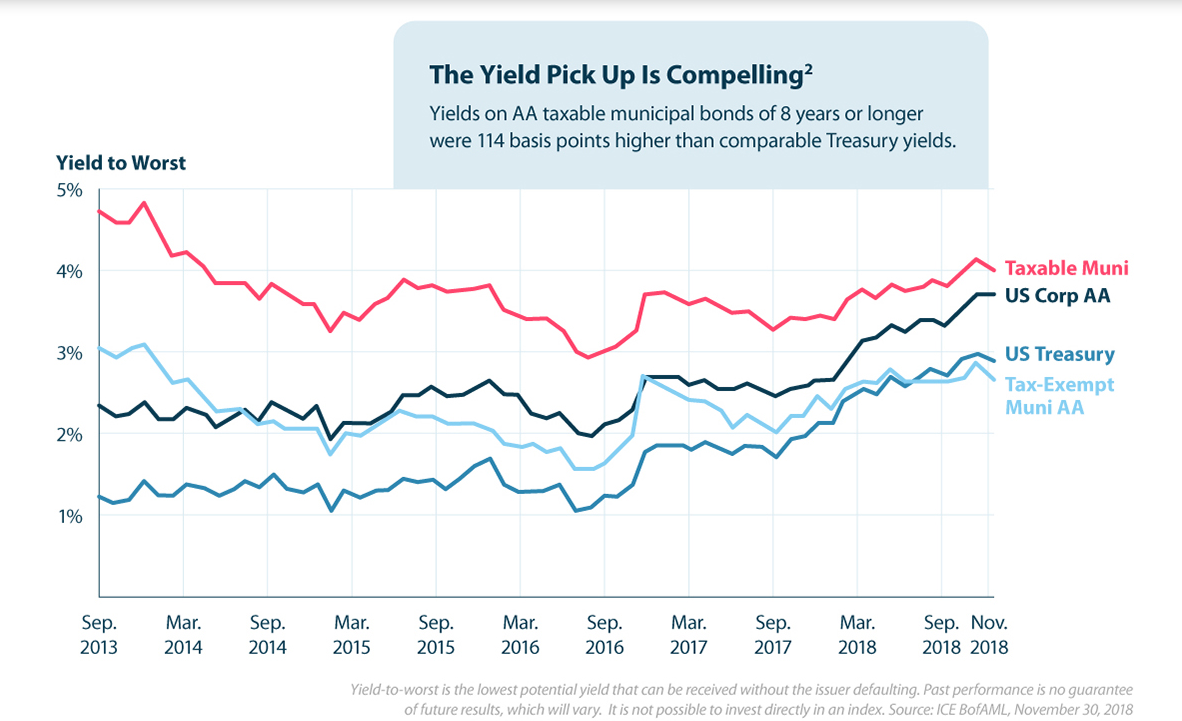

If investors haven’t already been allocating a portion of their fixed income portfolio to municipal bonds, now is the time to get that necessary exposure via exchange-traded funds (ETFs). A Visual Capitalist investment case cited the following reasons for municipal bonds:

- Historical yield paired with strong returns

- High-quality credit ratings

- Inefficient pricing, which could create value opportunities

- Low correlations to other assets

- Longer durations

“Municipal bonds are also quite popular with individual U.S. investors, as the interest income from the most municipal bonds is not subject to federal income tax,” the investment case noted. “As a result, many local and state governments have been turning to taxable municipal bonds to finance their infrastructure projects.”

Fixed income has seen a number of record flows this year into exchange-traded funds (ETFs) as investors look to gain core bond exposure as a more dovish central bank looks to cute interest rates this year. One area where investors may want to consider for additional fixed income exposure is the municipal bond market, which could see additional strength in the second half of 2019.

A Pair of Muni Bond ETFs to Consider

Municipal bonds are a specific corner of the bond market that has its own nuances to be wary of, such as costs and tracking errors, but this pair of ETFs eliminates the guess work involved–the Vanguard Tax-Exempt Bond ETF (NYSEArca: VTEB) and iShares National Muni Bond ETF (NYSEArca: MUB).

Investors need to be aware of the costs associated with investing in this fixed income space, as well as certain tracking errors that could arise with respect to their prices. As such, it’s appropriate to select the necessary ETFs that address these concerns like VTEB and MUB.