The amount of bonds circulating with negative debt yields appears to be dissipating in Europe, according to a recent Wall Street Journal article.

Global yields have been low for quite some time, and that accelerated when the pandemic struck in 2020 as investors piled into the safety of bonds. There was even talk that bond markets in the U.S. could experience negative debt yields at some point, but now that the global economy is starting to heal, bond yields are starting to rise again.

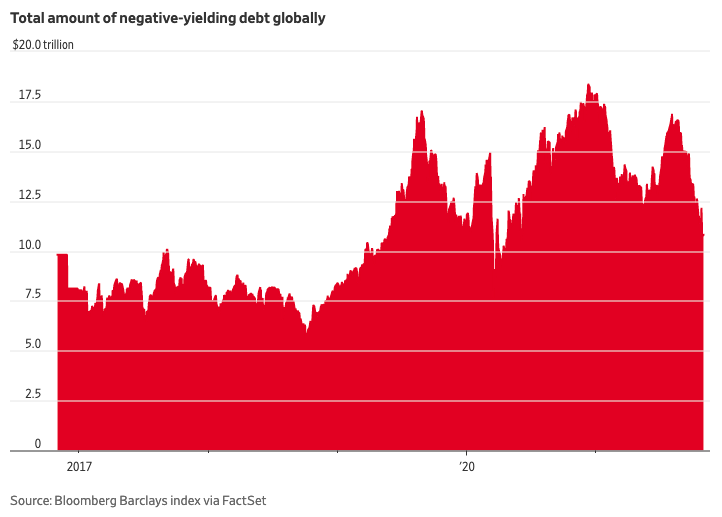

“French, Irish, Dutch and Swiss yields have all either turned positive or flirted with the line in recent weeks and months. German 10-year bond yields, the region’s benchmark, are still negative, but rose as high as negative 0.07% this week, the closest they have come to turning positive since April 2019,” the WSJ article says. “The moves have helped shrink the total stock of negative-yielding debt to $10.7 trillion this week, down from a peak of $18 trillion last December, according to a Bloomberg Barclays index. In addition to the eurozone, Switzerland and Japan are other economies with negative rates.”

As alluded to earlier, investors are anticipating that yields will begin to rise in 2022. The U.S. Federal Reserve has already noted that it would scale back its stimulus measures and start raising rates next year.

An International Bond Option

As yield rise globally, investors looking to get exposure to bond markets overseas can start with a total bond solution like the Vanguard Total International Bond Index Fund ETF Shares (BNDX). At a 0.08% expense ratio, fixed income investors get a low-cost solution for international exposure.

BNDX seeks to track the performance of a benchmark index that measures the investment return of non-U.S. dollar-denominated investment-grade bonds. International bonds can provide a diversification tool for fixed income investors looking to supplement their current core portfolio.

The ETF employs an indexing investment approach designed to track the performance of the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged), which provides a broad-based measure of the global, investment-grade, fixed-rate debt markets.

Summarily, BNDX:

- Attempts to track the performance of the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged).

- Employs hedging strategies to protect against uncertainty in exchange rates.

- Provides a convenient way to get broad exposure to non-U.S. dollar-denominated investment-grade bonds.

- Is passively managed, using index sampling.

For more news, information, and strategy, visit the Fixed Income Channel.