Fixed income investors seeking additional yield can opt for more risk/reward with assets like the Vanguard High Dividend Yield Index Fund ETF Shares (VYM).

Last year, the pandemic may have soured investors’ taste for high yield, but it’s quite a different story today.

“Corporations weathered the storm last year and have positioned themselves really well,” said Collin Martin, fixed income strategist at Charles Schwab. “Couple that with yield-starved investors going into anything and everything that offer better than a 0% yield, and it’s really the perfect storm to see spreads drop to those pre-financial crisis levels.”

The fund seeks to track the performance of a benchmark index that measures the investment return of common stocks of companies that are characterized by high dividend yield. The fund employs an indexing investment approach designed to track the performance of the FTSE High Dividend Yield Index, which consists of common stocks of companies that pay dividends that generally are higher than average.

The adviser attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

VYM:

- Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high dividend yields.

- Provides a convenient way to track the performance of stocks that are forecasted to have above-average dividend yields.

- Follows a passively managed, full-replication approach.

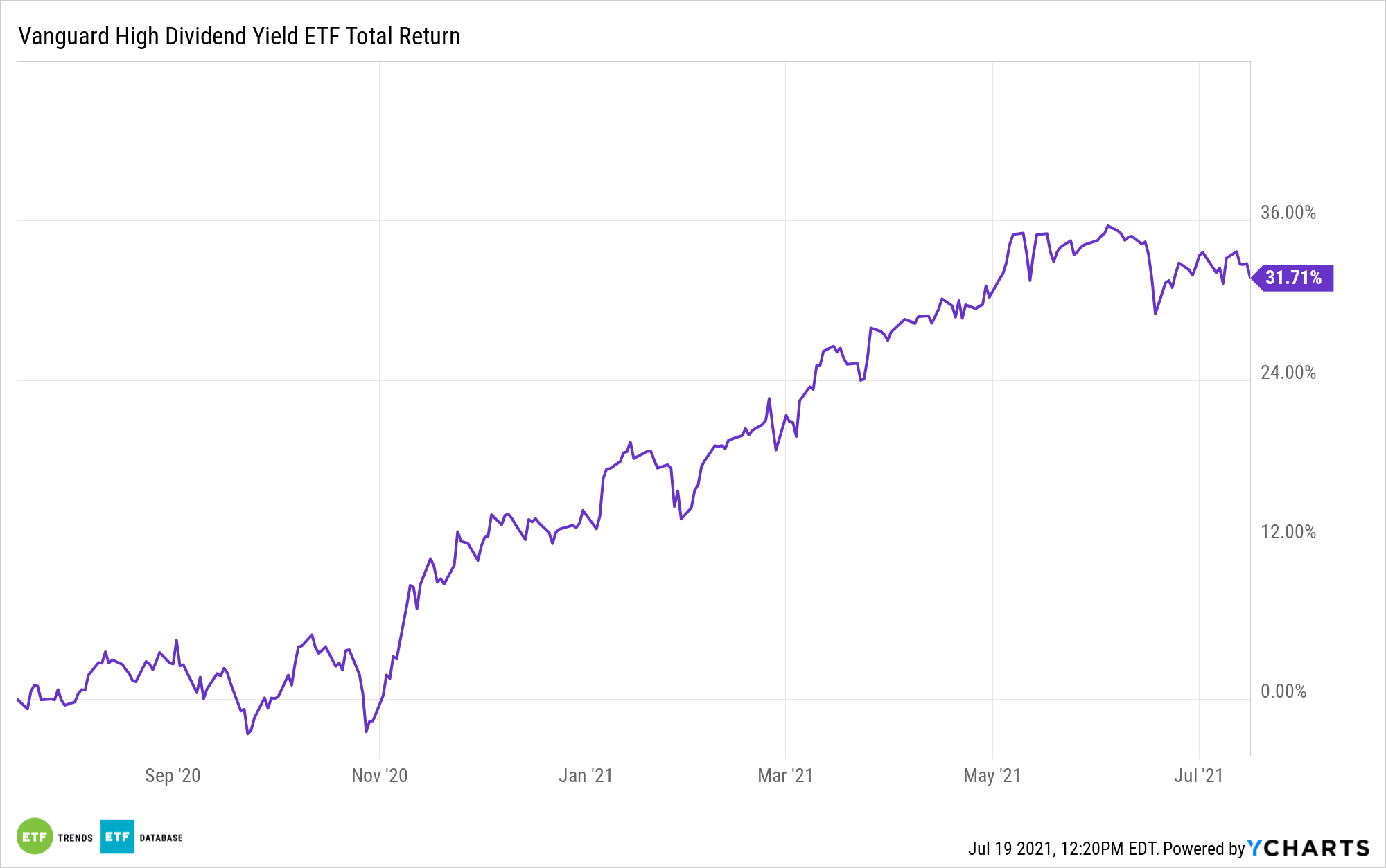

High Yield Making a Comeback

During the wake of the pandemic, fixed income investors weren’t inclined to touch the riskiest areas of debt due to the potential for defaults. Then the Federal Reserve decided to step in to shore up the bond markets, which included making purchases in the riskiest debt ETFs.

Nowadays, confidence is returning to the high-yield debt market and investors are quickly adding the debt issues to their fixed income portfolios.

“Junk bonds aren’t so junky anymore, with a strong fundamental backdrop helping to underpin what traditionally has been one of the riskiest sections of the financial markets.” a CNBC report said. “Yields in the $10.6 trillion space for the lowest-grade bonds in terms of quality are around historic lows after a tumultuous year that saw corporate America face down the Covid-19 pandemic and come out on the other side with balance sheets looking extraordinarily strong.”

For more news, information, and strategy, visit the Fixed Income Channel.