The spread between the 3-month and 10-year notes fell below 10 basis points for the first time in over a decade. This strong recession indicator contrasted a more upbeat central bank , but investors were quick to add more caution to their capital allocation.

Given this latest obstacle, fixed income investors now have to get strategic when it comes to the bond markets as well. One area that investors can look to is investment-grade debt issues with a prime focus on quality–with MINT, this quality is inherent in its exposure to investment-grade debt.

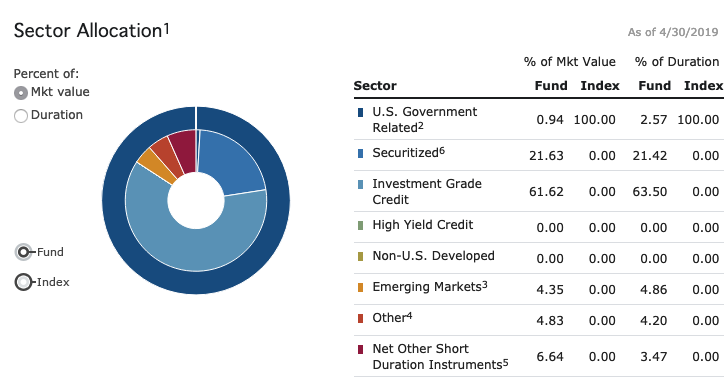

The default bond play to get broad-based exposure might be the iShares Core US Aggregate Bond ETF (NYSEArca: AGG), which tracks the investment results of the Bloomberg Barclays U.S. Aggregate Bond Index. The AGG gives bond investors general exposure to the fixed income markets, but there are times when current market conditions warrant a deconstruction of the AGG to extract maximum investor benefit.

In the case of MINT, it can serve as a standalone fixed income product in a portfolio or serve as a complement to a broad-based fund like AGG.

For more market trends, visit ETF Trends.