In today’s challenging bond market, it’s difficult to decide how an investor should get allocation to the space when parsing the plethora of opportunities available, especially when it comes to exchange-traded funds (ETFs). For short duration exposure, one option to consider is the PIMCO Enhanced Short Maturity (NYSEArca: MINT).

MINT seeks greater income and total return potential than cash and money market funds by investing in a broad range of high-quality short-term instruments.

“The type of bond fund you chose will depend on your specific investment objectives and your tolerance for risk,” stated an article on personal finance site RealDaily. “First, you should determine your time horizon.”

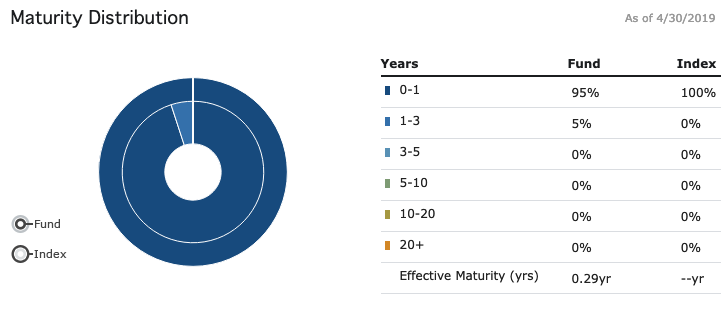

“Most short-term bond funds invest in debt instruments with a maturity of one year or less. Currently, given the minimal difference between short and long-term rates, these short duration bond funds can be appealing,” the article stated further.

The fund offers six distinct advantages:

- Increased return potential

- Capital preservation

- Rising rate protection

- Liquidity for non-immediate needs

- A complement to traditional bond allocations

- Low volatility relative to riskier assets

The bond markets threw a curve ball at fixed income investors earlier this year with an inverted yield curve, sending the capital markets overall on another volatile ride–something they may or may not have been accustomed to during the fourth quarter of 2018. The short-term 3-month and longer-term 10-year yield curve inverted–an event that hasn’t been seen since 2007–just ahead of the financial crisis.