Excerpt from Stanphyl Capital’s letter for the month of October 2018 discussing the impact of low interest rates on the earnings multiples and the housing market.

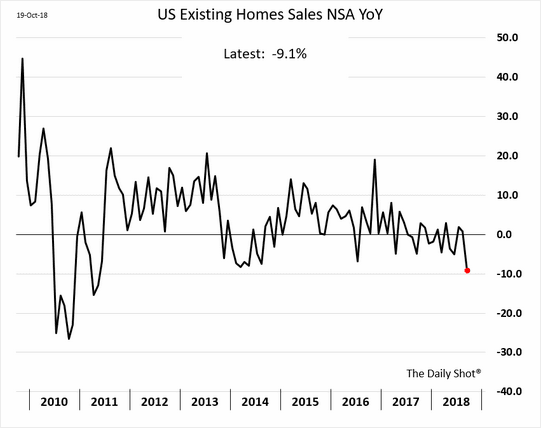

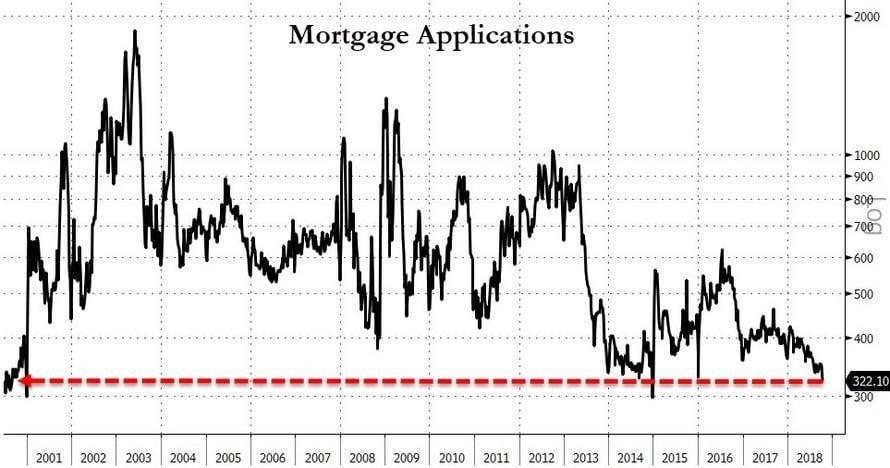

As noted in recent letters, through this entire bull market low interest rates were used to justify egregious earnings multiples on stocks, as well as creating those earnings via cheap mortgages, auto loans, debt-financed stock buybacks, etc., and yet now those rates are climbing. The result will be compressed corporate earnings multiples and a slowing in the all-important housing market…

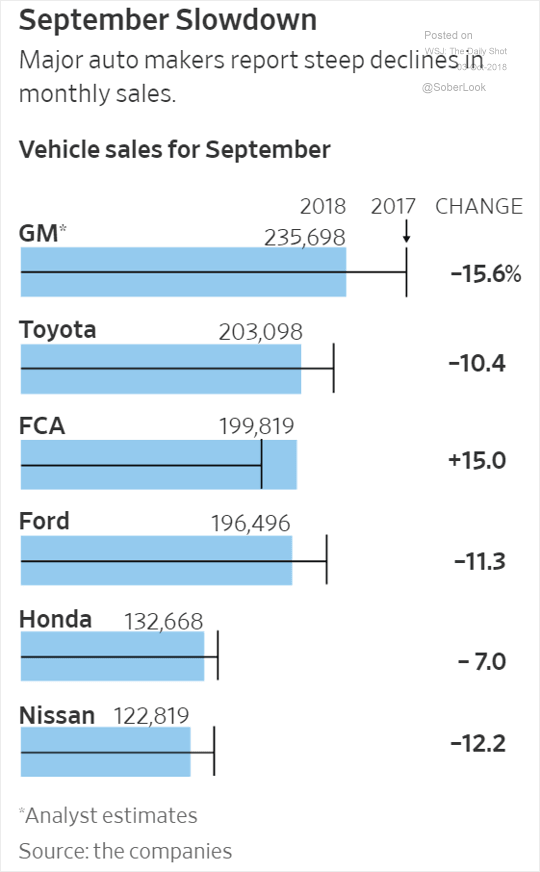

…and in auto sales…