Short-term bond funds can be great places to park cash. Vanguard has a pair of shorter duration options to consider.

Even with the Federal Reserve not looking at rate hikes for another year or so, short-term bond funds still have their place in a portfolio. Rather than parking cash into a low-yielding money market fund, bond ETFs can also be an option while the Fed figures out where to raise rates sooner rather than later.

“What the market continues to hear is the Fed is getting cold feet on flexible average inflation targeting,” Bank of America U.S. rate strategist Meghan Swiber said in a CNBC article. “What the market is pricing is effectively, if the Fed pre-empts a really full recovery in growth and inflation, that means they’re going to get a lower terminal rate.”

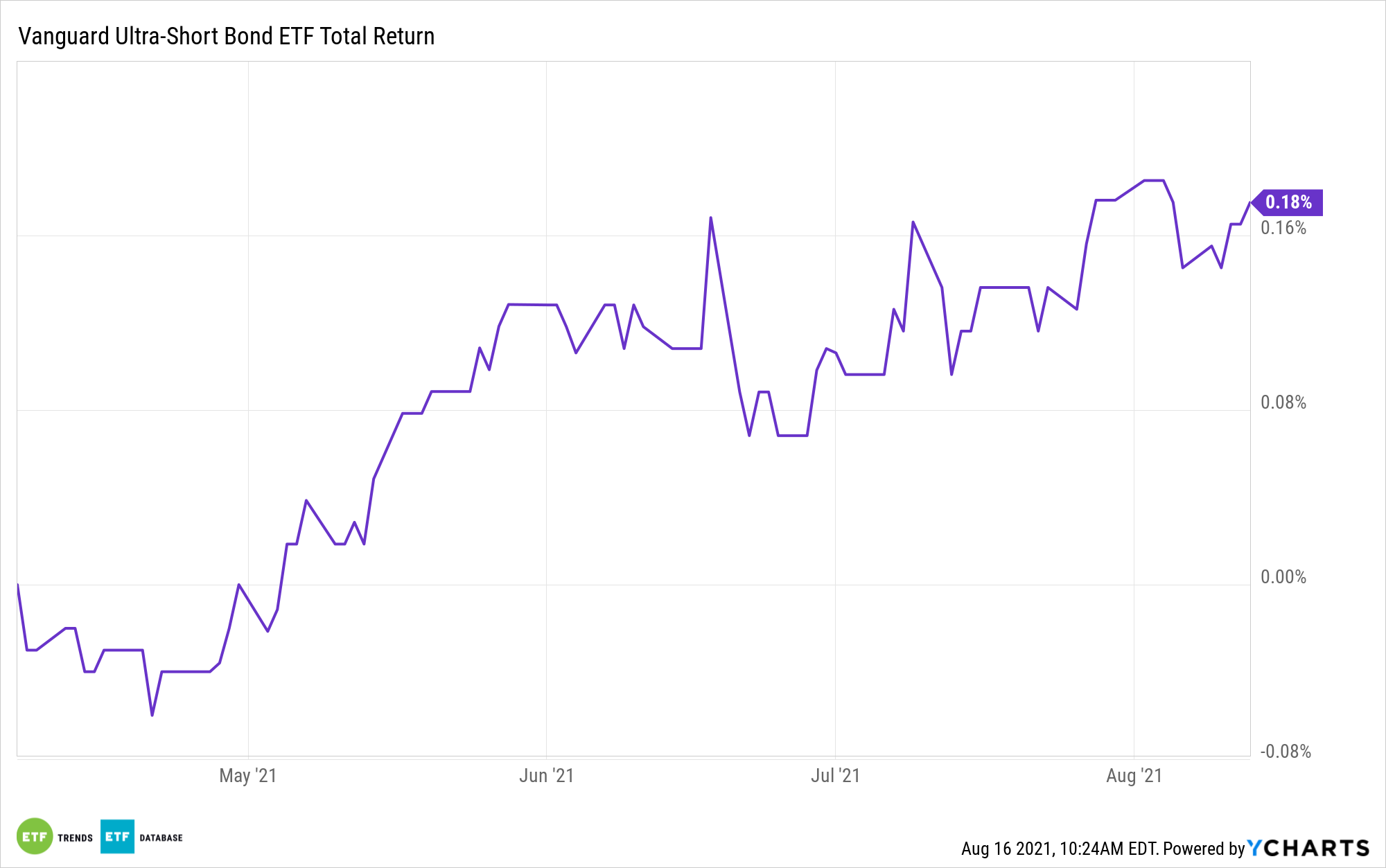

One Vanguard option is the Vanguard Ultra-Short Bond ETF (VUSB). With its low 0.10% expense ratio, VUSB’s investment objective is to seek to provide current income while maintaining limited price volatility.

VUSB invests in a diversified portfolio of high-quality and, to a lesser extent, medium-quality fixed income securities. It offers a dollar-weighted average maturity of 0 to 2 years.

Under normal circumstances, the fund will invest at least 80% of its assets in fixed income securities. The fund is designed to give investors low-cost exposure to money market instruments and short-term high-quality bonds, including asset-backed, government, and investment-grade corporate securities.

Stepping Further Out on the Yield Curve

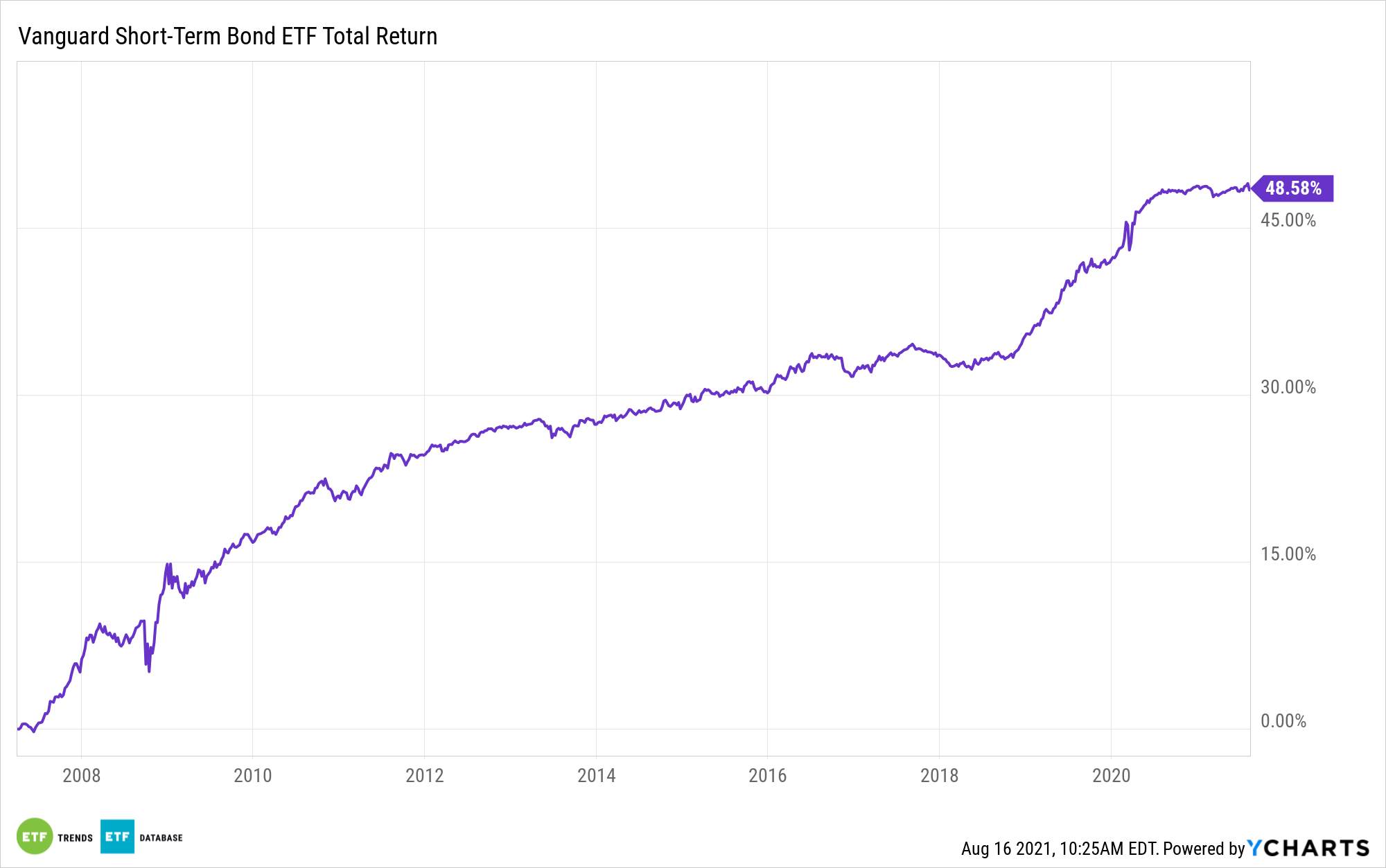

A second option to consider is stepping out a bit further out on the yield curve for more yield. An ETF option in this arena is the Vanguard Short-Term Bond Index Fund ETF Shares (BSV).

BSV seeks to track the performance of the Bloomberg Barclays U.S. 1-5 Year Government/Credit Float Adjusted Index. This index includes all medium and larger issues of U.S. government, investment-grade corporate, and investment-grade international dollar-denominated bonds that have maturities between 1 and 5 years and are publicly issued.

All of the fund’s investments will be selected through the sampling process, and at least 80% of its assets will be invested in bonds held in the index.

BSV:

- Seeks to track the performance of the Bloomberg Barclays U.S. 1–5 Year Government/Credit Float Adjusted Index, a market-weighted bond index that covers investment-grade bonds with a dollar-weighted average maturity of 1 to 5 years.

- Invests in U.S. government, high-quality (investment-grade) corporate, and investment-grade international dollar-denominated bonds.

- Follows a passively managed, index sampling approach.

For more news, information, and strategy, visit the Fixed Income Channel.