It’s a good time to be a bond fund as investor capital has been pouring into the debt markets despite lingering inflation concerns, which can erode the income derived by bond yields over time.

Nonetheless, that’s not stopping investors from heading into bond funds. It’s a move that some market analysts are unable to comprehend.

“Net inflows into US bond funds are far outpacing those for comparable equity instruments this year, confounding expectations that inflation fears would erode the appeal of fixed-income holdings,” a Financial Times article said. “Bond mutual funds and exchange traded funds have added $372bn as of June 23, compared with a gain of $160bn for equities, according to the Investment Company Institute. Bond funds are on pace to eclipse the $446bn of inflows in 2020 and $459bn in 2019.”

While equities markets are recovering from the pandemic amid a global vaccination movement, investors might still be skeptical about their true market value. This may be one reason investors have been preferred bonds over equities recently.

“Financial advisers follow asset allocation models and portfolio rebalancing and demographics are strong trends,” said Shelly Antoniewicz, ICI senior director of financial and industry research. “The cumulative flow to bond funds lines up nicely with the percentage of the population over 65 years.”

A Corporate Bond Option to Consider

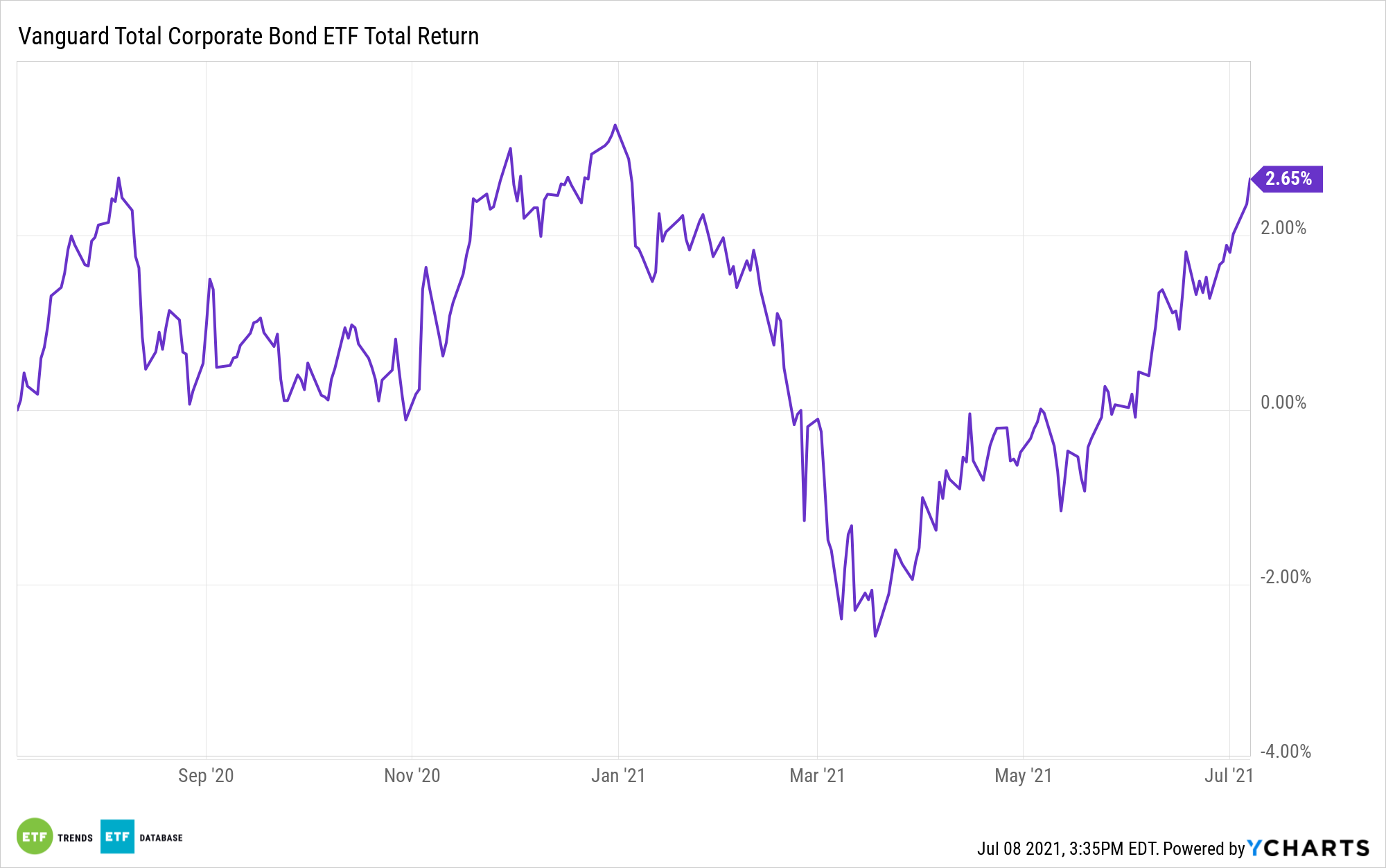

As credit markets start to improve, one option to consider is corporate bonds. Fixed income investors can snag this exposure with the Vanguard Total Corporate Bond ETF ETF Shares (VTC).

As for VTC, the fund seeks to track the performance of a broad, market-weighted corporate bond index. The fund is a fund of funds, and employs an indexing investment approach designed to track the performance of the Bloomberg Barclays U.S. Corporate Bond Index, which measures the investment-grade, fixed-rate, taxable corporate bond market.

The index includes U.S. dollar-denominated securities that are publicly issued by industrial, utility, and financial issuers. The fund comes with a low expense ratio of 0.05%.

VTC offers:

-

- Performance tied to the Bloomberg Barclays U.S. Corporate Bond Index.

- Broad, diversified exposure to the investment-grade U.S. corporate bond market.

- A unique ETF of ETF structure.

- An intermediate-duration portfolio, with exposure to short-, intermediate-, and long-term maturities.

- Current income with high credit quality.

For more news, information, and strategy, visit the Fixed Income Channel.