October is turning out to be a month marked by volatility with the Dow Jones Industrial Average falling the past week amid a confluence of factors like rising interest rates and weakness in Chinese equities.

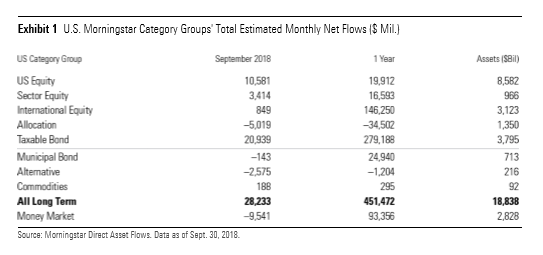

It was a piece of a much larger puzzle for 2018 outlined in the latest Morningstar Direct Asset Flows Commentary, which reflected the behavior of investors in September–notably, an influx of capital into taxable bond funds as well as an outflux from international markets.

According to the report, 2018 looks to be the third consecutive year that taxable bond funds will receive the greatest inflows out of the eight U.S. category groups. Taxable-bond demand was split among three segments–core, intermediate-term bond funds, ultrashort-bond funds and lastly, long government funds.

There was a notable shift out of equity funds as investors may be sensing that the extended bull run may finally be running out of steam and into core bond funds.

“First, investors are moving money into core, intermediate-term bond funds. This category received about $6.1 billion in September and leads all taxable-bond categories with about $55 billion year to date. These inflows may reflect investors rebalancing and shifting money from equity funds,” the report said. “Second, rate-sensitive investors are pouring money into ultrashort-bond funds. This category collected $5.3 billion in September and is just behind intermediate-term bond funds for the year to date with about $54 billion. Finally, long government funds received about $3.6 billion in September inflows. These funds have historically diversified equity portfolios well, but their 2018 success is still surprising.”