The municipal bond space represents a specific corner of the bond market that has its own nuances to be wary of, such as costs and tracking errors. During the month of May, investors were willing to take on the risk as more funds were piled into even riskier high yield munis.

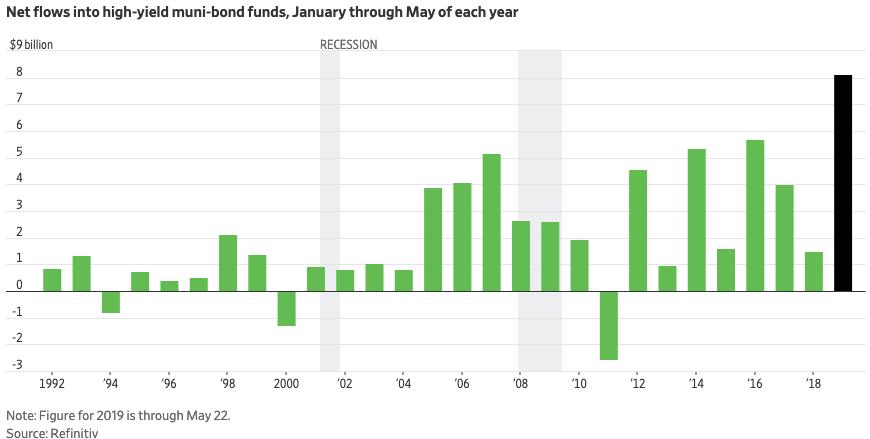

Through May, investors poured in $8 billion of capital, according to data from Refinitv–the most since the year 1992. Furthermore, municipal bond funds took in $37 billion, which was the most in almost 30 years.

Munis may have also gotten a boost following last November’s midterm elections. In particular, with respect to infrastructure spending—it’s one of the few things, if any, that Democrats and Republicans can agree on, but with the newly-divided Congress, this could fuel municipal bond ETFs.

Still, investors need to be aware of the costs associated with investing in this fixed income space, as well as certain tracking errors that could arise with respect to their prices.

For investors looking to get into the door of municipal bond ETFs can look at the Vanguard Tax-Exempt Bond ETF (NYSEArca: VTEB) and iShares National Muni Bond ETF (NYSEArca: MUB).

With bond market mavens warning investors of headwinds in the fixed income space like the possibility of an inverted yield curve, rising rates and BBB debt sliding out of investment-grade, investors need to be keen on where to look for opportunities.

One area is within the municipal bond space, which may have gotten a boost following last November’s midterm elections. In particular, with respect to infrastructure spending—it’s one of the few things, if any, that Democrats and Republicans can agree on, but with the newly-divided Congress, this could fuel municipal bond ETFs.

Still, investors need to be aware of the costs associated with investing in this fixed income space, as well as certain tracking errors that could arise with respect to their prices.

As such, it’s appropriate to select the necessary ETFs that address these concerns like VTEB and MUB.

VTEB tracks the Standard & Poor’s National AMT-Free Municipal Bond Index, which measures the performance of the investment-grade segment of the U.S. municipal bond market. MUB seeks to track the investment results of the S&P National AMT-Free Municipal Bond IndexTM, which also measures the performance of the investment-grade segment of the U.S. municipal bond market.

The sampling approach means that both funds hold a subset of bonds within the index in order to replicate the yield, duration, and credit quality of the debt. This method allows the funds to avoid trading expensive bonds that could harm performance and in addition, minimize tracking errors.

With respect to an average net expense ratio of 0.32 percent in their category, both funds deliver very low costs–0.08 percent for VTEB and 0.07 percent for MUB.

For more market trends, visit ETF Trends.