Sound familiar? Since the Financial Crisis, investors have allocated significantly more funds into bonds than stocks. Only now are investors awakening to the risks of rising inflation.

“What is the worst investment against inflation? Bonds. The objective of governments who are overly indebted will be to devalue bonds so that their burden can be reduced. Yet, what are investors doing these days? They are aggressively buying bonds and moving away from equities. They rant against debt but continue to buy government notes or leave cash in the bank at 1% interest.”

What is the best hedge against inflation? Owning companies with unique products that have high pricing power. If I were a German investor in 1945, I would have wanted to own Porsche, Beck’s, Hugo Boss, Bayer, Braun, and Nivea.

The value of the German currency could have gone to zero, but if the brands were solid, you still could have realized a profit in any currency. Our job is to select solid companies that can withstand inflation and other economic risks.” Francois Rochon, 2010

Prices are being Manipulated

The global central banks have become the price setter in the bond market. Having taken short rates to zero, for the first time in history, the global central banks sought to lower the long end of the curve by buying bonds. The endgame was to force investors into riskier assets, [e.g. junk bonds, equities, real estate], create a wealth effect, and stimulate the economy. This may very well be the biggest ‘peg’ in financial history.

“While we are aware that debt markets can persist at zero or even modestly negative rates for a period of time, we believe it is best to make capital allocation decisions on the basis that fixed income securities will eventually trade where a fixed income investor would own them rather than where governments and fixed income traders will push them.” Larry Robbins

Historic Underperformance

Earlier this century, only bonds were deemed a safe investment; equities were considered too speculative. As a result, bond yields were lower than the yields on common stocks.

“After the great market decline of 1929 to 1932, all common stocks were widely regarded as speculative by nature. A leading authority stated flatly that only bonds could be bought for investment.” Benjamin Graham

This changed after the 1930’s when it dawned on investors that stocks offered more upside than bonds, as the retained earnings after dividend payments could compound within the company…

“To report what Edgar Lawrence Smith discovered, I will quote a legendary thinker – John Maynard Keynes, who in 1925 reviewed the book, thereby putting it on the map. In his review, Keynes described ‘perhaps Mr. Smith’s most important point … and certainly his most novel point.

Well-managed industrial companies do not, as a rule, distribute to the shareholders the whole of their earned profits. In good years, if not in all years, they retain a part of their profits and put them back in the business. Thus there is an element of compound interest (Keynes’ italics) operating in favor of a sound industrial investment.

“It was that simple. It wasn’t even news. People certainly knew that companies were not paying out 100% of their earnings. But investors hadn’t thought through the implications of the point. Here, though, was this guy Smith saying, “Why do stocks typically outperform bonds? A major reason is that businesses retain earnings, with these going on to generate still more earnings–and dividends, too.” Warren Buffett

“In the 1920s, a brilliant and important book by Edgar Smith, Common Stocks for Long-Term Investment, became a prime market influence. It was still popular in the fall of 1929, but most people read it too late.

Mr. Smith advocated the benefit to corporate growth of the application of retained earnings and depreciation. Thus capital appreciates. The book may have been influential in changing accepted multiples of 10 x earnings to higher multiples of 20 to 30 x earnings.” Roy Neuberger

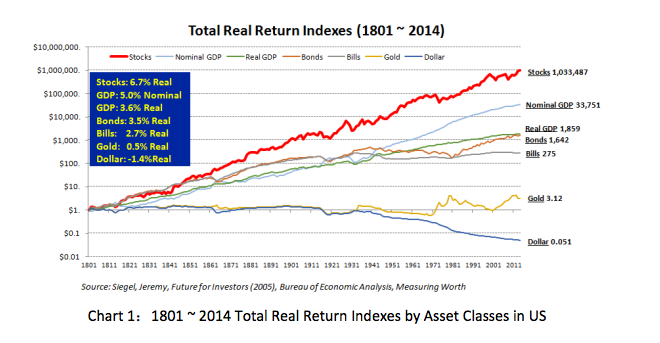

And outperform they did. Analysis by Professor Siegel of the Wharton School of Business highlights returns on several major classes of financial assets, including stocks and bonds, in the US during the past two hundred years. The figures are staggering. Long term bonds significantly under-performed stocks.

![]()

Source: Li Lu’s Lecture ‘The Prospect of Value Investing in China’

“Here is the result: 1 US dollar in stocks, after discounting for inflation, experienced an appreciation of 1 million times the original value over the past 200 years! Its value today would be 1.03MN US dollars. Even the remainder of this number is bigger than the return on every other class of assets. What are the reasons behind such an astonishing performance? The answer lies in the power of compounding. The average annualized rate of return for stocks, discounting inflation, is only 6.7%. No wonder Einstein called compound interest the eighth wonder of the world.” Li Lu

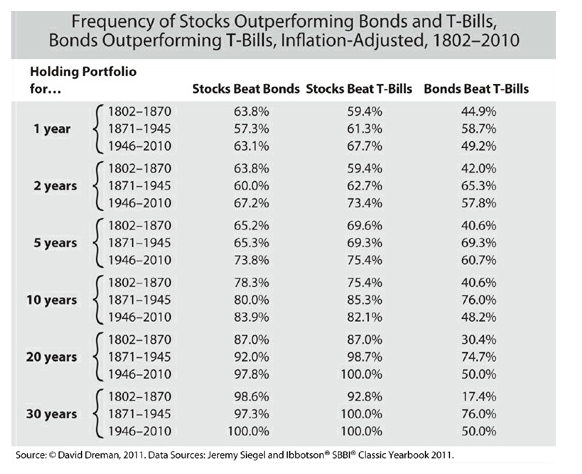

David Dreman’s excellent book ‘Contrarian Investment Strategies’ contains a chapter titled ‘An Investment for All Seasons’ which states; “I will make clear, the crucial but little known fact that stocks are not a risky investment, if you hold them for a number of years… stocks also keep their value better than almost any other investment through hyperinflation and most other crises.”

![]()

Dreman noted .. “Stocks outperformed T-bills 73% of the time for all five year periods between 1802 and 1996, 81% for ten year periods, 95% and 97% respectively for 20- and 30- year periods. The results after the war are better yet. For any five year period stocks outdistanced T-bills 82% of the time, and for any 20-year or 30-year period 100% of the time. The comparison with long bonds are nearly identical.” David Dreman

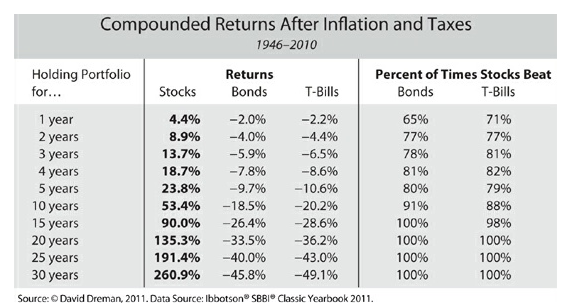

![]()

Mr Dreman concludes.. “the probability that the investor holding stocks will double her capital every 10 years after inflation, quadruple every 20, combined with 100% odd that she will outperform T-bills or government bonds in 20 years, can hardly be called risky. Conversely, the supposedly ‘risk-free’ assets actually display a large and increasing element of risk over time.”

Mr Dreman is not alone. The Investment Masters recognise this …

“The S&P outperformed inflation, Treasury bills, and corporate bonds in every decade except the ‘70’s, and it outperformed Treasury bonds – supposedly the safest of all investments – in all four decades.” Sir John Templeton

“Stocks outperformed bonds, as Edgar Lawrence Smith, Irving Fisher, and John Maynard Keynes noted as far back as the twenties.” David Dreman

“Practical experience demonstrates that stocks provide superior returns over reasonably long holding periods.” David Swenson

“In spite of crashes, depressions, wars, recessions, ten different presidential administrations, and numerous changes in skirt lengths [for 60 years until 1987], stocks in general have paid off fifteen times as well as corporate bonds, and well over thirty times better than Treasury bills” Peter Lynch

“In the very long term, equities represent the best investment class.” Francois Rochon

“Stocks have historically outperformed over moderate to longer periods by a significant amount.” Ed Thorp

And that’s likely to continue in the future..

“In the long run, a portfolio of well-chosen stocks and/or equity mutual funds will always outperform a portfolio of bonds or a money-market account. In the long run, a portfolio of poorly chosen stocks won’t outperform the money left under the mattress.” Peter Lynch

“The unconventional, but inescapable, conclusion to be drawn from the past fifty years is that it has been far safer to invest in a diversified collection of American businesses than to invest in securities – Treasuries, for example – whose values have been tied to American currency. That was also true in the preceding half-century, a period including the Great Depression and two world wars. Investors should heed this history. To one degree or another it is almost certain to be repeated during the next century.” Warren Buffett

Notwithstanding, there may be occasions where it makes sense to invest in bonds.

“… though the value equation has usually shown equities to be cheaper than bonds, that result is not inevitable: When bonds are calculated to be the more attractive investment, they should be bought.” Warren Buffett

The last time was back in the 1980’s when bond yields peaked at 15% plus.

“We remember vividly 35 years ago staring at long-term impeccable bonds trading at 15% to 17% yields, thinking; “Why bother trading, hedging and knocking ourselves out? Why not just liquidate the whole portfolio and own these things and go on vacation for 10 years?” Paul Singer

“Anyone with a sense of contrarian mentality had to look at interest rates in the early 1980’s as presenting a potentially great opportunity. You knew the Fed would have to ease as soon as business started to run into trouble. In addition, we had already seen an important topping in the rate of inflation.” Michael Steinhardt

“In 1981 the public should have seen Volcker’s jacking up of short-term rates to 21 percent as a very positive move, which would bring down long-term inflation and push up bond and stock prices.” Stanley Druckenmiller

“When I purchased long-term zero-coupon bonds in the early 1980’s at market yields in excess of 13%, I welcomed the prospect of outsized volatility because I felt it would eventually work in my favour.” Frank Martin

That’s not the case today..

“It is possible that there could be a time where a wise investor could be all in treasuries. It is virtually impossible for me to see when. I guess I could imagine it, but I haven’t seen it. Long-term treasuries are a losing battle over the long pull.” Charlie Munger, 2018

Warren Buffett once again espoused his thoughts in his most recent letter …

“I want to quickly acknowledge that in any upcoming day, week or even year, stocks will be riskier – far riskier – than short-term U.S. bonds. As an investor’s investment horizon lengthens, however, a diversified portfolio of U.S. equities becomes progressively less risky than bonds, assuming that the stocks are purchased at a sensible multiple of earnings relative to then-prevailing interest rates.

It is a terrible mistake for investors with long-term horizons – among them, pension funds, college endowments and savings-minded individuals – to measure their investment “risk” by their portfolio’s ratio of bonds to stocks. Often, high-grade bonds in an investment portfolio increase its risk.”

So let’s wrap it up.. over the very long term, stocks have outperformed bonds by a significant margin. As an investor’s holding period lengthens, the chances of a portfolio of quality businesses [low debt, good management, pricing power, etc.]purchased at reasonable prices outperforming a bond portfolio rises.

Notwithstanding, if you require funds in the short term, or you can’t stomach a large decline in the quoted prices of your portfolio of stocks, you probably shouldn’t be investing in the stock market. With rates as close to zero as they’ve been in decades, today’s bond market looks like a bubble to me. It’s little wonder the world’s greatest investors continue to favour quality businesses over bonds. Wouldn’t you?