On the other hand, by reducing your equity exposure when stocks are highly-valued, and increasing your equity exposure after large declines, you may be able to outperform and reduce volatility, but it’s harder to do.

Whatever you do, don’t chase performance. Don’t start to overweight equities after they’ve already gone up a lot. Stay focused on long-term growth and proper diversification.

2) Take a Look at Your Bonds

Long-term bonds are more sensitive to interest rate risk than short-term bonds.

A rising rate environment gives investors better bond yields, but the prices of existing bonds decline because their yields need to align with yields issued by new bonds.

Here’s a simplified discounted cash flow equation for bond pricing, showing that when the expected rate of return (i) goes up to complete with newly-issued higher-yielding bonds, the current bond price must decrease:

If you have a diversified bond fund that includes bonds of various maturities, you probably don’t need to worry about this too much. But if you want to tweak it a bit, shorter-term bonds and cash can hold up better in rising rate environments than longer-term bonds.

3) Invest Abroad, Especially in Emerging Markets

In addition to the United States, interest rates are rising in Canada, Mexico, and several other countries. And they’re holding roughly flat for the time being in most of Europe and Japan (but their central banks are tapering off their support).

But in many emerging markets, interest rates are declining. Not all global economies are synchronized, and this can give investors opportunity.

I’m a strong advocate for investors having emerging markets exposure over the next ten years, and I weight them significantly in my personal portfolio.

Any individual year might be bad, because that’s the nature of markets, but I’ll be surprised if emerging markets as a whole don’t outperform U.S. equities over the next decade.

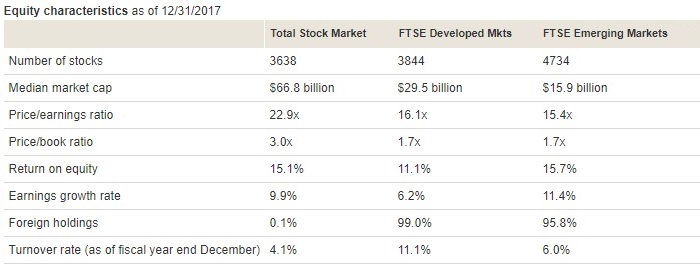

Here is the valuation comparison between the total U.S. stock market, developed international markets, and emerging markets:

![]()

Source: Vanguard

Emerging markets are trading at lower price-to-book multiples and lower price-to-earnings multiples than their developed counterparts, but have faster earnings growth.

From 2002-2007, emerging markets had a massive valuation increase, resulting in extremely highly-valued stocks. As a result, even though they continued to grow over the past decade, their stock returns have been largely flat as valuations declined, which offset that growth.

But going forward, their valuations are now down to reasonable levels and their future returns are expected to be better. Their economies are growing more quickly than developed markets while starting now from a point of reasonable valuations.

4) Buy Companies that Benefit from Rising Rates

While interest rates are inversely proportional with stock valuations in general, it doesn’t mean there aren’t individual companies that earn bigger profits when interest rate spreads are higher.

Banks are the most commonly-used example. They make money by borrowing at a very low rate (typically via savings accounts), and lending at higher rates (like mortgages). When interest rates are very low, the spread between these rates is small, but when rates are higher, they can earn bigger profits from a bigger spread.

As the Federal Reserve began increasing interest rates, average bank net interest margins quickly followed.

Quickly rising interest rates can be problematic for banks, but in general higher interest rates by the Federal Reserve allows banks to operate at a higher net interest margin, which means better profitability.

Insurance stocks benefit even more directly from higher interest rates.

The way insurance companies work is that they collect a lot of insurance premiums, pay out a lot of customer claims, and all the while they keep a “float” that they can invest conservatively and keep the profits. They don’t make much money from the actual insurance business; they make the bulk of their money from the investment income that they can generate on their float.

Insurance companies primarily invest in bonds. They usually hold their bonds to maturity, so they don’t care about changes in bond prices; they only care about yield and safety. In low interest rate environments, top-quality bonds pay very low rates and barely keep up with inflation. But in high interest rate environments, good bonds pay out higher yields.

For that reason, insurance companies become more profitable when they can invest in investment-grade bonds that pay decent yields. In other words, when interest rates are higher.

I cover bank stocks frequently in my free newsletter, and show what investments I’m personally holding.

5) Shop for Bargains in Rate-Sensitive Investments

On the other end of the spectrum, sometimes the market overreacts to investments that are considered sensitive to interest rates, which allows for contrarian investors to go bargain-hunting.

Very asset-heavy businesses need to use a lot of leverage to earn decent returns on equity, but they can safely support that level of leverage due to the high reliability of their cash flows. But because they use so much debt financing, when rates go up their costs of borrowing go up quite a bit as well. Plus, as rates go up investors demand higher yields from dividend-paying equities, meaning their stock prices decline.

This makes the market perceive them as sensitive to changing interest rates.

Real Estate Investment Trusts (REITs) for example, are commonly thought of as moving sharply inversely to interest rates. They use leverage for real estate and pay high yields. When rates go up, REITs go down, right?

Well, not exactly. As articles like the one in that link show, interest rates don’t have a significant impact on REIT performance over the long term, even if it increases their volatility in the short term. Especially if you buy high-quality REITs that use mostly fixed-rate financing and maintain stronger than average balance sheets.

As of this writing, REITs are already down nearly 20% from their 2016 high.

When you’re worried about the potential for high valuations and market crashes, look at areas where markets have already crashed and now have reasonable valuations.

According to most valuation metrics, REITs are a better buy right now than the S&P 500 if your holding period is long enough to let fundamental investing work its magic.

The largest REIT fund, Vanguard’s Real Estate ETF VNQ, offers a diversified low-cost high-yielding investment, or you can hand-pick your REITs for potentially better performance.

A lot of investors are worried about the “Amazon Effect” on REITs, because real estate is becoming less important as online commerce keeps taking market share. I used to shop at Target for supplies and go to malls for clothes and shoes, but now I get most of my supplies from Amazon and a lot of my clothes and shoes from Zappos (owned by Amazon).

However, the index that VNQ follows now only has 15% exposure to retail REITs, and a significant percentage of this chunk consists of things like restaurants, gyms, convenience stores, club warehouses, and other Amazon-resistant things.

The other 85% consists of properties like cell towers, residential apartments, offices, data centers, retirement homes, hospitals, hotels, and industrial properties, including logistics properties that benefit from online commerce.

I maintain a mostly rate-agnostic portfolio, meaning I specifically balance asset-heavy equities (like infrastructure and real estate) with financials (like banks and insurers), which complement each other well.

Final Words

Investing over the past 9 years has been easy, because just about everything has gone up.

Going forward, it’ll get more challenging again. We’re later in the business market cycle, valuations are high, and interest rates are rising.

The way I’m approaching this is continuing to be diversified, and investing more heavily in areas that are cheaply-priced relative to their historical norms and fundamentals.

I currently like emerging markets, quality financial stocks, energy/commodities, and REITs at current prices, but also remain broadly diversified into various asset classes.

This article has been republished with permission from Lyn Alden.