Investors are picking themselves up in 2019 after a tumultuous way to end 2018. The Dow Jones Industrial Average fell 5.6 percent, while the S&P 500 was down 6.2 percent and the Nasdaq Composite declined 4 percent.

2018 marked the worst year for stocks since 2008 and only the second year the Dow and S&P 500 fell in the past decade. In 2019, investors are no doubt reassessing their strategies for how to distribute their capital through the rest of the year.

As markets have cycled out of the growth and momentum-fueled investments of 2019, a move to more quality-oriented investments are in order. Identifying these quality-based investments, however, will require more due diligence.

The default bond play to get broad-based exposure might be the iShares Core US Aggregate Bond ETF (NYSEArca: AGG), which tracks the investment results of the Bloomberg Barclays U.S. Aggregate Bond Index. The AGG gives bond investors general exposure to the fixed income markets, but there are times when current market conditions warrant a deconstruction of the AGG to extract maximum investor benefit.

As more investors begin to add fixed income to their portfolios, it will take more of a strategic bent. This is especially so since the Federal Reserve said during its fourth and final rate hike in December 2018 that it will do more reassessing, which could mean lesser rate hikes in store for 2019.

With the short-term strategy of lesser rate hikes in store, the long end of the curve, however, is much less clear. As such, investors will need more guidance for their fixed-income portfolios.

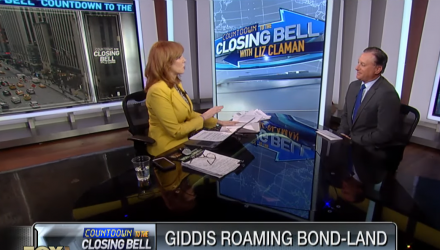

The end of 2018 also spurred a move to bonds as investors sought after safe-haven alternatives amid the volatility. In the video below, Kevin Giddis, Raymond James head of fixed income, gives tips on investing in the bond market.

For more market trends, visit ETF Trends.