Whether it be value, growth, quality, momentum, or other market factors, investors are saying, “Bring it on.” The newly published 2019 Invesco Global Factor Investing Study shows that investors are ready to look into these funds as the market landscape requires them to get more strategic when it comes to their capital allocations.

Vincent de Martel, Senior Invesco Investment Solutions Strategist, told ETF Trends that factor investors interviewed for the Invesco factor study are continuing to deepen the use of these strategies in their portfolios.

“This materializes in the expansion of the opportunity set in equities and increasing demand for fixed income factor solutions,” de Martel said. “In equities, we’re seeing strong buying activity in factors such as low volatility as investors seek to maintain participation to the equity market with lower downside risk.”

He added the journey towards risk reduction or return enhancement started for many investors by experimenting with one or two factor strategies, especially value.

“Respondents to the Invesco survey are now increasing allocations to not just low volatility but also quality and momentum,” he said. “In addition, many investors now see the potential for outperformance through a dynamic rotation between factors, a fact that industry pundits may not have expected only a few years ago when a static allocation was considered optimal.”

de Martel said market conditions in fixed income marked by low yields and an inverted yield curve is pushing investors to consider enhancing portfolios by adopting in fixed income the factor approach they have become familiar with in the equity world.

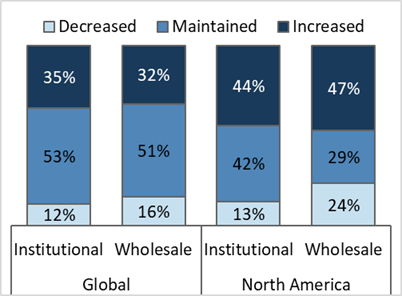

This year, the study found that respondents have continued to increase factor allocations overall; both in the number of factors they target and their usage of multi-factor strategies. Nearly half (45%) of the investors surveyed globally increased factor allocations in the last year, and 65% of investors in North America intend to increase their factor allocations over the next three years. Also, in 2019 over 66% of respondents have also reported that their factor investing performance met or exceeded expectations the performance of their traditional active or market-weighted allocations. Investors are also maintaining their conviction in factor investing with 77% of respondents in North America waiting at least three years before judging performance.

Invesco also reveals that investors, in aggregate, are 1) more widely interested in factor fixed income strategies and have opinions on which factors should work best, 2) moving to a more dynamic approach for implementation of factors by a three-to-one majority, 3) taking more defensive, long-term factor positions.

Factor Fixed Income Ready for Prime Time

Since last year’s Global Factor Study, there has been a notable increase in the proportion of North American respondents who believe factor investing can be extended to fixed income. Invesco found that 61% of institutional investors and 76% of wealth managers now view the approach as being applicable. The growing belief is tied to widespread recognition that the returns of all fixed-income portfolios, whether they are built utilizing a factor-based approach or not, will be implicitly driven by exposure to factors. (Figure 1)

Sample size: Global, Institutional = 98, Wholesale = 74, NA, Institutional = 45, Wholesale = 17

“With interest rates now at record lows and around a quarter of bonds globally trading with negative yields, attention has turned to alternative ways of accessing the asset class,” continued Haghbin. “Respondents see factor investing as a solution that could target sources of returns transparently and cost effectively, even in a challenging yield environment.”

Of the potential factors identifiable within fixed income, belief in a yield/carry factor is the most prevalent, with 64% of respondents identifying it as the top factor, which may explain the increase to such strategies over the past 12 months. Additional factors to be explored in fixed income, yield/carry was followed by liquidity, value and quality (54%, 46% and 42% respectively). (Figure 2)

Sample size: NA = 41, Global = 156

Bond market inefficiencies, coupled with a near four-decade bull-market run, have helped to support the case for active management within fixed income. Factor investing in fixed income includes many of the benefits that have driven the strong performance of active fixed-income strategies, while also offering transparency and a potentially attractive cost.

This year’s results suggest that as investors move along the experience curve, demand for fixed income factor strategies will likely increase further.

Active Implementation is on the Rise

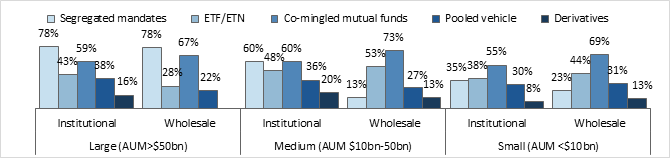

The Invesco Global Factor Study addresses implementation and finds that investors increasingly believe that capturing the benefits of factor investing is partially dependent on adopting a dynamic approach. Most factor investors now choose an active implementation as opposed to a passive approach – with active strategies executed through segregated mandates, co-mingled mutual funds, customized investment solutions and exchange traded funds (ETFs). The assortment of investment vehicles being utilized ensures factor accessibility for a wide range of investors.

For active implementation, the study found, there is a preference for segregated mandates among larger institutional investors and wealth managers, while mid-sized and small investors are more likely to opt for co-mingled mutual funds. Notably the use of ETFs is not limited to one type of investor and is used in the implementation of both active and passive factor strategies. ETFs are utilized for dynamic factor investing by nearly 60% of large institutional investors (AUM>$50BN), usually in combination with other investment vehicles. (Figure 3)

Sample size: Large (AUM >US$50bn), Institutional = 31, Wholesale = 12; Medium (AUM US $50bn-US$10bn); Institutional – 17, Wholesale = 13; Small (AUM <US$10bn), Institutional = 38, Wholesale = 44.

Where investors still implement strategies passively, mid-sized (71% institutional and 77% retail) and small investors (68% institutional and 84% retail) are primarily using ETFs, while large institutional investors prefer a custom approach to index design.

“The increase in dynamic factor investing is a key sign of how comfortable investors are becoming in implementing factor strategies,” continued Haghbin. “We continue to rely on the insight provided by the Global Factor Study to enhance our products and services in order to provide investors with the factor solutions that best fit their needs.”

Migration to Defensive Factors

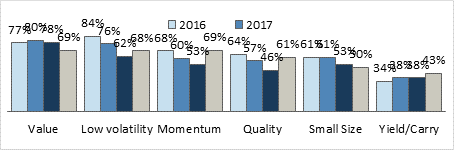

As investors continue to adopt a more dynamic approach to factor investing, with an eye on a longer time-horizon, allocations across factors have increased. The rigorous internal research processes that Invesco surveyed being implemented in 2018 seem to be reflected in the 2019 rise of low volatility, quality and momentum. At the same time as investors are moving to multi-factor, they are taking more active decisions about which factors to include or exclude. (Figure 4)

Sample size: 2016 = 56, 2017 = 98, 2018 = 260, 2019 =236

Despite some decline in exposure to the value factor, which was used by eight of ten respondents in 2018, value remains the most widely allocated factor. Invesco found that some of the sophisticated investors sampled had increased allocations to value over the past 12 months. Among these respondents, this year’s study noted that the underperformance of value raises questions how the value factor should be defined and captured in the prevailing economic environment, rather than raising serious questions about its viability as a factor.

For more information, visit 2019 Invesco Global Factor Investing Study.