Fixed income exchange traded funds are increasingly tapping into socially responsible investing themes. A good example of that trend is the newly minted iShares Global Green Bond ETF (NasdaqGM: BGRN), which debuted last week.

The iShares Global Green Bond ETF tries to reflect the performance of the Bloomberg Barclays MSCI Global Green Bond Select (USD Hedged) Index, which is comprised of global investment-grade green bonds issued to fund projects with direct environmental benefits, according to the fund’s prospectus.

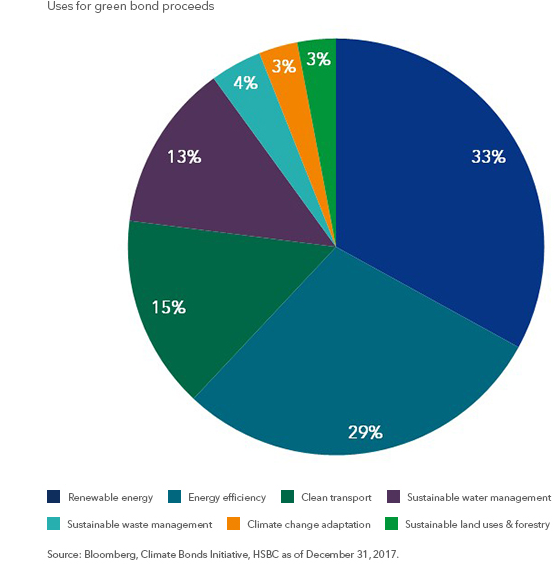

Green bonds are fixed income debt securities where the proceeds are exclusively applied to projects or activities that promote climate or other environmental sustainability purposes.

“A green bond is a debt instrument in which the issuer commits to using the borrowed money for projects deemed environmentally beneficial,” said Ashley Schulten, BlackRock’s head of responsible investing for global fixed income, in a recent note. “These can include everything from installing solar panels at factories to improving energy efficiency to constructing green buildings.”

Chart Courtesy: BlackRock

More BGRN ETF Details

BGRN holds 176 bonds and has a duration of 6.95 years. Duration measures a bond’s sensitivity to changes in interest rates. The green bond market is over a decade old, but recently has received more attention and is expected to be home to rapid growth in the coming years.