We’ve had it drilled into us that you should invest for the long-term. Save early, save often and use the power of compound interest. Am I right? But what if you have a short term goal, how should you invest for the short term?

Have you read the important notes? It’s a condition for reading this blog.

How should you invest for the short term?

Investing for retirement is a decade’s long process. Both in the accumulation phase and then in the spendown phase, so you’ve gotta play the long game. There is no shortage of material around to tell you how to invest for the long-term, and I would say most FIRE blogs are concerned with this key goal.

However, there are times in your life where you may have a short-term goal, such as saving for an older child approaching college years, or replacing a car in a few years. These are near-term spending requirements that you might want to meet with a saving strategy. But the key question is, if you save for a near-term goal, then what investment strategy will maximize your probability of meeting that goal?

Separate Buckets

You might not think about your obligations in different buckets, but actuaries certainly do.

You have many different obligations that you need to meet, and these range from the short-term, to medium term and the very long term. For example, you might have to meet the following obligations:

- Pay utility bills this month

- Meet the credit card payment at the end of the month

- Pay for some repairs on your house

- Pay your high school senior’s first year college fee

- Purchase a replacement car in two years\

- Save for a down-payment on a house in 3-5 years

- Save for retirement

Now clearly some of these obligations are so short term that it only makes sense to meet them from current cashflow. You will be using your monthly salary (or other income source) to meet the short-term commitments like paying off your credit card. It would make no sense to invest for a month to meet this payment.

We’ve already discussed the long-term, but what about those medium term commitments that have a horizon of around 2-5 years?

You may want to set aside some money each year to pay for a car replacement in 3 years. But should you invest that money, and how should you invest it?

One Bucket

You may feel that you have one investment strategy and do not differentiate between near term, and long-term goals. This can be a particularly relevant viewpoint if you have significant savings compared to your obligations. If you think you will need to buy an $8,000 car (say) in three years and you have seven figure savings then adopting different investment strategies is unlikely to move the needle. Your dominant goal (usually retirement) will drive your overall investment strategy.

However if you need to meet a particular mid-term goal and you do not have the resources to fall back on, then optimizing your saving strategy is important. For example if you fail to save the $8,000 required for the car, and as a result you will have to take out a loan (sub-optimal), or raid highly appreciated after-tax savings and take the tax hit (also sub-optimal), then this will be of interest to you.

Hurrah for Short-termism!

For our example let’s suppose that you need to meet a nice round $10,000 payment in three years’ time. Either you could set aside $3,333 per year to meet this, or you could set aside a lower sum, invest it, and hope it grows to meet your obligation of $10,000. [Actually in my work I’m going to assume inflation is present and so you would need more than $3,333 in cash, since it deflates over time.]

The problem is that investing is rarely a certain game and we need to evaluate whether it is worth taking stock market risk over such a short period.

You could luck-out and only have to contribute $2,500 per year, but the market could go south and you then run the risk that you have to make a large final contribution in order to shore up any deficiency.

Analysis

Yay, finally we get to some analysis!

As per previous analyses, I am going look at inflation adjusted stock and bond returns from 1802 to 2015. We are going to get into some ‘back-testing’ of different investment strategies. Let’s look at 10 different portfolios with varying stock/bond mixes, going from 0% equities to 100% equities in 10% increments.

First we will look at the minimum annual contribution requirement (MCR) to hit our $10,000 target after 3 years for a 60% equity portfolio.

![]()

Contribution rate

- Minimum contribution for three year horizon to meet $10k

- So surprise, surprise it’s pretty volatile. That’s equities for you. There is no certainty there. Depending on which cohort your three year period experienced, you might have required upwards of $4,000 per year, or if you were lucky, as little as $2,500 per year. Remember a cash investment would require around $3,333 per year. So for this portfolio it is sometimes better than cash, and sometimes worse.

Short term investment strategies

I get some really nice emails from readers – so thanks if you have taken the time to drop me a line! I have also been getting emails from actuaries. Yay for actuaries! If you are an actuary then drop me a line to let me know what you think of the blog. If you like what you’ve read then please tell your friends and share on social media.

Risk and Return

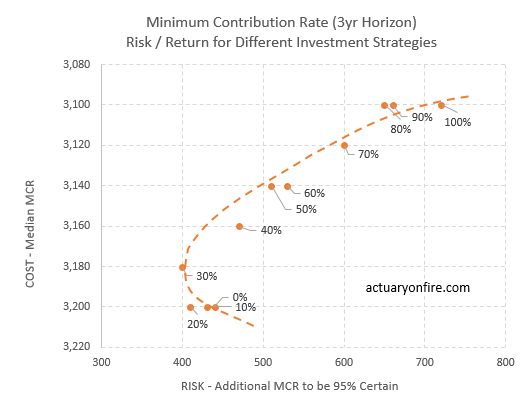

We need a way to think about the tradeoff in investing in equities over this short period. Let’s evaluate the cost and risk of each portfolio.

COST – I’m going to quantify this as the median contribution rate required to hit our target.

RISK – I’m going to measure this as the difference between the median and 95th percentile. In other words this is the additional annual contribution required to be 95% certain that I will hit my target.

The following risk / return chart shows all the portfolio results.

![]()

Risk and Return

If you have read some of my other posts on 529 investing then you will remember that the vertical axis goes backward. This means that points in the top left corner are low risk and low cost portfolios – that it good! Ideally you want to get a portfolio that is as much in the top-left as possible.

But there is generally a trade-off. As you decrease the expected cost, you increase the risk that you have to plug a shortfall with a big cash contribution.

Look at the 100% equity portfolio. The cost is around $3,100. This means that you have a 50/50 chance of only having to contribute $3,100 per year to meet $10,000 in three years. But the risk is around $700. Which means that to be 95% sure of meeting your target you would need to contribute $3,800 per year.

Related: High Dividend Stocks: A Lonely Opportunity?

In other words you have a good chance of doing better than cash, but there is a decent chance you could under-perform cash over this period.

What’s interesting is that the high equity portfolios do not look optimal at all. A better mix of cost and risk is perhaps 30%-50% equities. That is much less than is typically recommended for an early-retirement portfolio. The investment horizon makes a difference!

Cash is King(?)

In the world of investable assets, cash is the runt of the litter. But it does have a key benefit of retaining nominal value, and over this short time period inflation is not too important. So cash is a pretty safe investment. Note that for an early retiree cash is a risky investment since it loses purchasing power. (Have you been reading the inflation risk series from Karsten/ERN and I? Part 1, Part 2 and Part 3).