So let’s incorporate cash into our portfolio.

![]()

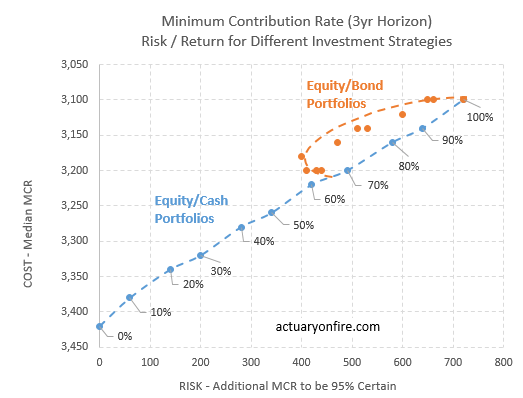

Short term investment strategies

Short term investment strategies including cash/equity portfolios.

The blue dots show cash/equity portfolios. So the 30% blue point is a portfolio with 70% cash and 30% stocks.

You can see that an all cash portfolio with zero equities has zero risk (unsurprisingly) and a cost of around $3,420. Remember it’s not $3,333 per year because cash loses purchasing power.

It’s also unsurprising that as you progressively add equities to a cash portfolio the result is lower expected cost but higher risk.

Optimizing

We need a way to find the optimal portfolio. We clearly want a low cost and a low risk, so it makes sense to look at COST+RISK.

Recall that my COST is the median contribution, and RISK is the additional contribution to be 95% certain, so COST+RISK is just the total annual contribution to be 95% certain.

The following chart plots this measure.

Short term investment strategies

We are looking for the lowest points on this chart, since that minimizes the cost and risk.

If we take a mix of equities and bonds, then 30% equities / 70% bonds produces the lowest annual contribution of around $3,600 per year to be 95% certain of meeting our goal of $10,000 after three years.

However check out the 100% cash portfolio – it is the lowest point. That has an annual contribution of $3,420 per year to be 95% certain of meeting our goal. Adding equities just adds risk, without sufficient reduction in cost.

Conclusion

I was surprised by this.

Maybe not Whoah! fall-off-my-chair surprised.

But, certainly mildly startled.

We all know that if you are investing for the long-term, such as early retirement, then you need to have a large proportion of your assets in equities in order to maximize your chance of success.

But this analysis is saying that in order to maximize your chance of success in investing to hit a target over the short-term, then you should avoid equities! I had imagined that the optimal equity allocation might be lower than for a retirement portfolio (say 30% instead of 70-80%), but I had not thought that cash would be quite so compelling.

So I’m (somewhat reluctantly) concluding that if you are saving to meet a specific target over 2-5 years and you absolutely have to meet this target then 100% cash is the way to go. But, if you have other resources and funds to fall back on then you could stick with your long-term asset allocation.

When Does Short-Term Become Long-Term?

Holy smokes! What a great question!

We believe that to meet a very long-term investment goal then a high equity allocation is optimal. It also seems from this analysis that to be sure of meeting a short-term goal then 100% cash is optimal. But when does the short-term become long-term?

Dunno.

I need to do some more analysis on this. (I do have other things I need to do ya’ know!) So stay-tuned, because I am eager to investigate the bifurcation of investment strategy from cash to equities and I hope you’ll join me on what will likely be a wild ride! (ok, I probably over-sold that last point, but if you’ve made it this far through the post then you gotta admit this is fun – right?)

Do you have a single asset allocation that you stick with, and don’t concern yourself with whether you have short-term or long-term obligations? What do you do if you have to meet a short-term obligation? Do you save in a special bucket to meet that goal? Or do you lump it all together with all your goals, including retirement goals?

This article has been republished with permission from Actuary on Fire.