As you can see, the economic conditions that accompany different points in time may influence the number of companies buying back shares, but not necessarily the returns of a buyback strategy.

The effect of interest rates on buyback activity

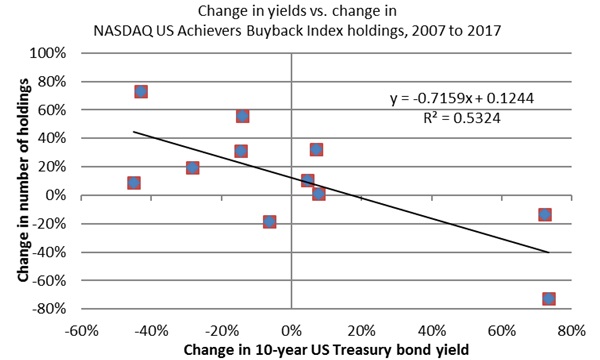

One of the factors that can affect buyback activity is interest rates. In the chart below, note the inverse linear relationship between the change in interest rates, as represented by the 10-year US Treasury bond, and the corresponding number of companies in the NASDAQ US Buyback Achievers Index.

![]()

Falling rates can make it cheaper to repurchase shares, while rising rates can make it more expensive to do so, creating the downward-sloping trend line in the graphic. During this time, the change in rates explained about 53% of the variation in the number of holdings in the NASDAQ US Buyback Achievers Index.

The effect of investment activity on buyback activity

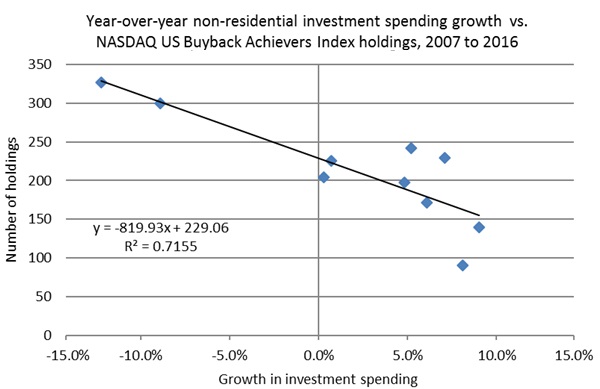

When companies spend less on plant and equipment, they may have more capital available to repurchase shares. Alternatively, repurchasing shares may also indicate that buying back stock is more attractive than an investment in plant or equipment.

The graphic below displays the relationship between the year-over-year change in nonresidential investment spending and the number of stocks in the NASDAQ US Buyback Achievers index. Note that periods of slumping investment experienced a pickup in the number of companies buying back shares, while periods of rising investment produced just the opposite. During this time, the growth of investment spending explained about 71% of the variation in holdings in the index.

So why did buyback lag in 2014 and 2015?

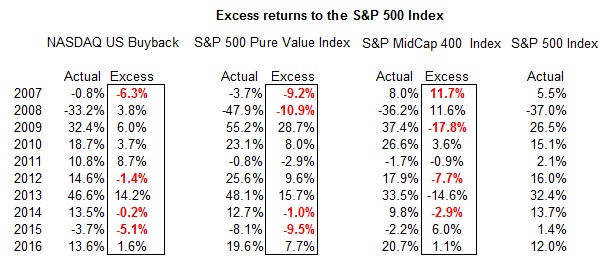

Buyback as an investment strategy lagged in 2014 and 2015. I believe this was primarily because of market conditions. The NASDAQ US Buyback Achievers Index tilts toward the value and small-size factors because buyback is a form of value investing, while the companies meeting the buyback threshold of 5% tend to be less concentrated in size than a market-cap-based index like the S&P 500 Index. As the table below indicates, during years in which buyback underperformed, value (represented by the S&P 500 Pure Value Index) and/or small-size (represented by the S&P MidCap 400 Index) were out of favor.

Considering what I’ve outlined above, I believe buyback investors should stay focused on stock buybacks as a signal of value, but should also be aware of the economic backdrop. Buyback strategies may potentially do well when the value and small-size factors are in favor, but can’t necessarily be expected to outperform during periods of low interest rates or slow investment activity, when companies are more likely to execute buybacks.

Investors interested in buyback strategy should explore the PowerShares BuyBack Achievers Portfolio (PKW) or the PowerShares International BuyBack Achievers Portfolio (IPKW).