As market headwinds from a trade war impasse buried the capital markets in volatility during the month of May, a de-risking occurred in funds specializing in high yield like The High Yield ETF (NYSEArca: HYLD). The fund, however, adjusted its strategy by making a move towards quality debt holdings as investors sought more fixed income exposure during this volatile swing.

HYLD seeks high current income with a secondary goal of capital appreciation. The Sub-Advisor seeks to achieve the fund’s investment objective by selecting a focused portfolio of high-yield debt securities, which include senior and subordinated corporate debt obligations, such as loans, bonds, debentures, notes, and commercial paper.

The fund does not have any portfolio maturity limitation and may invest its assets in instruments with short-term, medium-term or long-term maturities. It invests at least 80 percent of its net assets in high-yield debt securities.

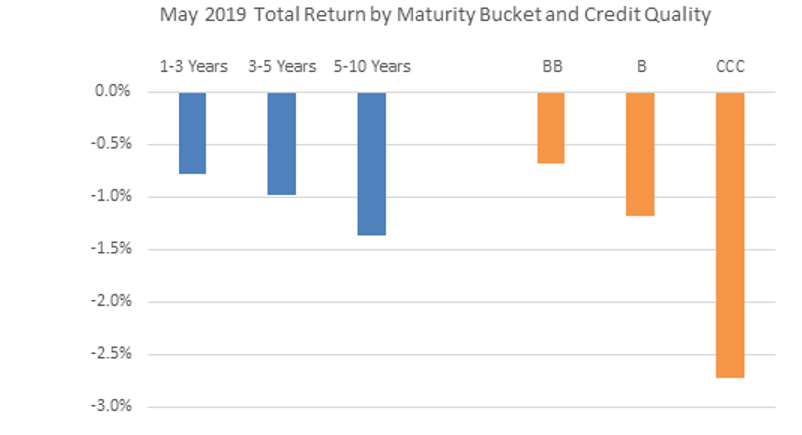

“As shown in the following chart, moving up quality and shortening average maturity was clearly successful in May, and were the factors contributing most to our outperformance relative to the benchmark,” the fund wrote in an email.

An Alternative to Equities

U.S. equities rallied in 2019, and then took a dive following the latest U.S.-China trade deal news, but investors are always on the hunt for income–they could find those opportunities in high yield. As such, lower equity returns for the rest of 2019 could translate to more interest in high-yield funds like HYLD.

The Portfolio Manager relies on their own fundamental credit analysis with an emphasis on a company’s ability to pay back their debts with free cash flow. HYLD seeks to provide high income and diversification benefits to the income portion of a portfolio.

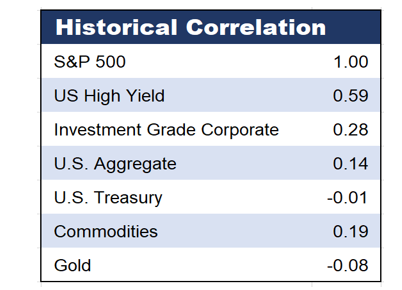

Furthermore, its correlation with the S&P 500 gives investors an alternative to traditional equities.

The tide could turn for high-yield bond ETFs, especially now that the Federal Reserve is sounding more accommodative with respect to interest rate policy. Following the fourth and final rate hike of 2018, the central bank is now taking a more cautious approach with rates, which could lead to static rates through the rest of 2019.

The central bank didn’t show much dynamism in 2018 with respect to monetary policy, obstinately sticking with a rate-hiking measure with four increases in the federal funds rate. That appears to have changed given the current economic landscape, and especially in the capital markets as Fed Chair Jerome Powell is now preaching patience and adaptability.

For more market trends, visit ETF Trends.