IEMG is also up 8.42 percent thus far in 2019, which is a far cry from the 14.93-percent decline it experienced in 2018. The fund gained close to 40 percent in 2017 and 10.29 percent in 2016.

The turnaround comes after EM assets were decimated in 2018 thanks to a mix of trade wars and rising interest rates in the U.S.

“Emerging markets had a rough time last year, and this is quite a turnaround,” said Megan Greene, chief economist at Manulife Asset Management. “This rally could have legs.”

A High-Yield Option

An option to consider in the EM high-yield bond market is the VanEck Vectors EM High Yield Bond ETF (NYSEArca: HYEM). HYEM seeks to replicate the ICE BofAML Diversified High Yield US Emerging Markets Corporate Plus Index, which is comprised of U.S. dollar denominated bonds issued by non-sovereign emerging market issuers that have a below investment grade rating and that are issued in the major domestic and Eurobond markets.

According to Morningstar performance numbers, HYEM has yielded a 4.46 percent return thus far in 2019. The fund gives investors the necessary diversification versus relegating a portfolio’s fixed income allocation to domestic investment-grade debt.

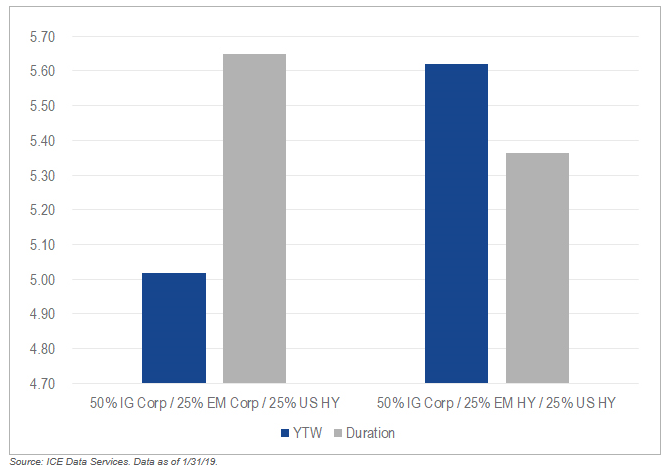

“In contrast to investment grade rated bonds, emerging markets high yield corporate bonds are not eligible for inclusion in a broad U.S. high yield index such as the ICE BofAML US High Yield Index, so there is virtually no overlap in terms of issuers or individual bonds,” wrote Rodilosso. “From a diversification standpoint, this is reflected in a lower correlation to U.S. investment grade corporate bonds and to core bonds versus broad emerging markets corporate bonds. Further, using emerging markets high yield bonds rather than an all-rating exposure provided a higher yield, with less interest rate risk.”

For more market news, visit ETFTrends.com.