Chinese bonds made their debut on the Bloomberg Barclays Global Aggregate Index on Monday–a move that would give investors more access to China’s $13 trillion bond market. Markets analysts are expecting that this inclusion would garner a capital influx of $150 billion in foreign inflows.

Over the course of the next 20 months, these Chinese bonds will be added to the global index. Bonds that will be included in the index are the following:

- Chinese government: 159

- China Development Bank: 102

- Agricultural Development Bank of China: 58

- Export-Import Bank of China: 45

“Today marks an important milestone as China’s capital markets continue to find their place in the global investment mainstream,” said Justin Chan, HSBC’s co-head of global markets in Asia Pacific.

China is becoming less resistant to safeguarding its businesses, which will open the pathways to more foreign investment. China ETFs have also been the beneficiaries of index provider MSCI Inc. announcing recently that it would quadruple its weighting of large-cap Chinese shares in its benchmark indexes.

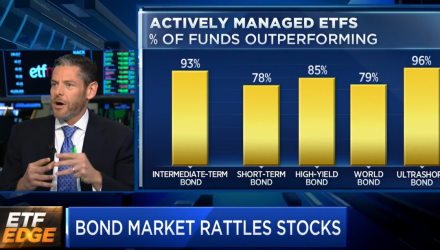

With this latest development, how do investors approach bonds in the current market landscape? PIMCO’s Jerome Schneider breaks down how to play the bond market with CNBC’s Bob Pisani.

For more market trends, visit ETF Trends.