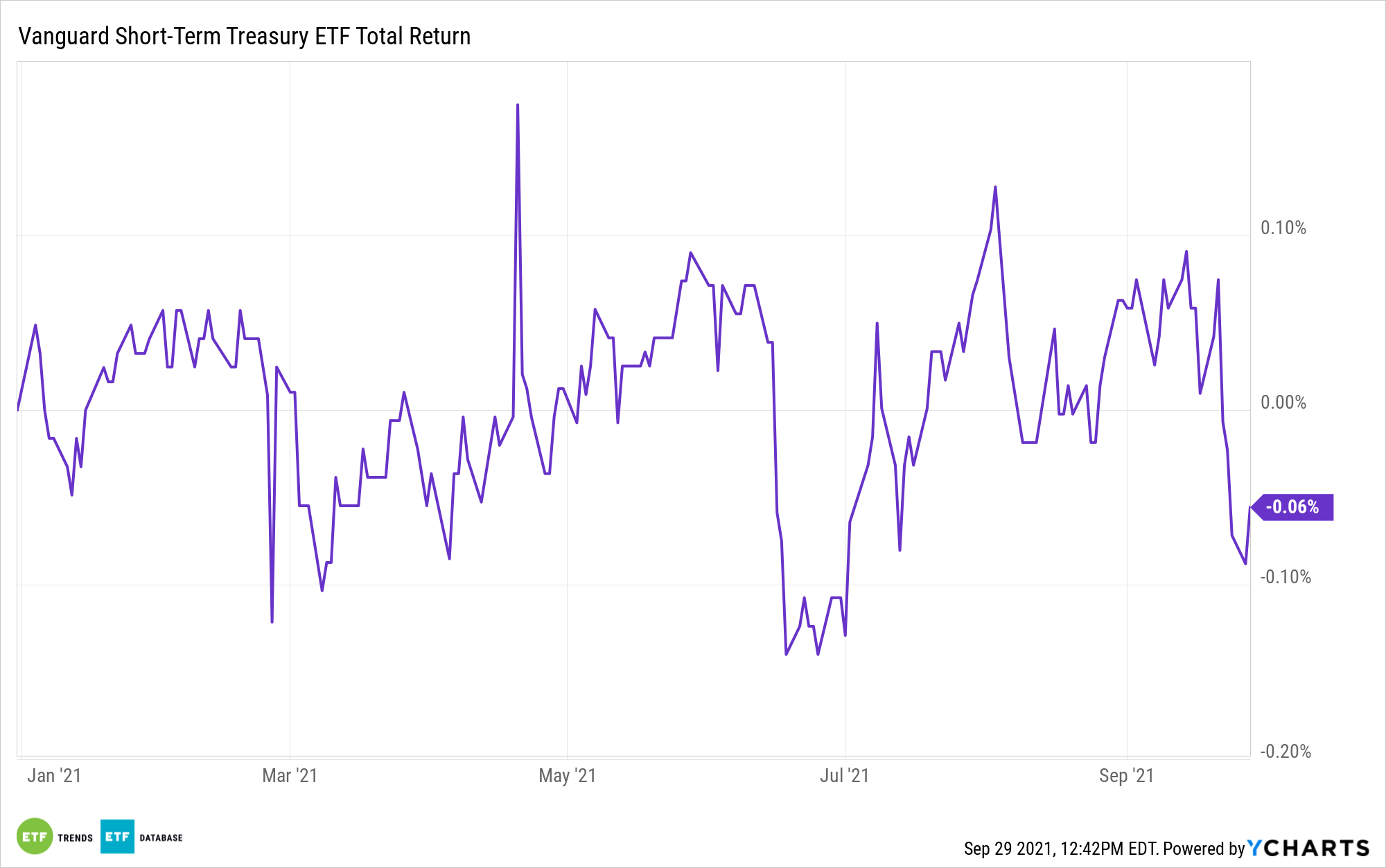

U.S. Treasury yields have been on the move higher, making fixed income investors wary of shortening their duration with ETFs such as the Vanguard Short-Term Treasury ETF (VGSH).

Shortening duration can help with interest rate risk as yields continue to tick higher. The benchmark 10-year note in particular reached a high not seen in a couple of months as it continued to push past the 1.5% yield marker.

“We’re definitely seeing a break above key resistance,” said Simpler Trading director of options Danielle Shay.

“I’m looking at the 10-year to go at least 1.5%, and if it can go above that area of resistance, then I’m looking at even 1.7,” Shay said. “With that, I’m looking primarily at the banks and any type of trading companies.”

How high can yields go? Various global investment firms give an indication of where they could be headed — namely, right around the 1.5–1.75% marker.

“We’re looking for 1.50 to 1.75 on the 10-year by year-end. That’s been our call all year, and we’re certainly sticking with that call,” said Piper Sandler senior technical research analyst Craig Johnson. “Bank of America is among the most highly correlated coming back to interest rates.”

A Prime Option to Consider in Today’s Market

With short duration in focus, VGSH is a prime option to consider. This ETF offers exposure to short-term government bonds, focusing on Treasury bonds that mature in one to three years.

It’s an ideal option, given the uncertainty in the current market environment. Bonds can offer investors a safe haven against stock market volatility, while short-term bonds limit the risks of potential rate rises that can rob investors of fixed income opportunities.

“This ETF offers exposure to short term government bonds, focusing on Treasury bonds that mature in one to three years,” an ETF Database analysis suggested. “As such, interest rate exposure for this product will be towards the low end, giving VGSH safe haven appeal as an asset that avoids both credit risk and interest rate risk.”

Overall, VGSH:

- Seeks to provide current income with modest price fluctuation.

- Invests primarily in high-quality (investment-grade) U.S. Treasury bonds.

- Maintains a dollar-weighted average maturity of one to three years.

For more news, information, and strategy, visit the Fixed Income Channel.