Pensions STILL have annual investment return assumptions ranging between 7–8% even after years of underperformance.

However, the reason assumptions remain high is simple. If these rates were lowered 1–2 percentage points, the required pension contributions from salaries, or via taxation, would increase dramatically. For each point reduction in the assumed rate of return would require roughly a 10% increase in contributions.

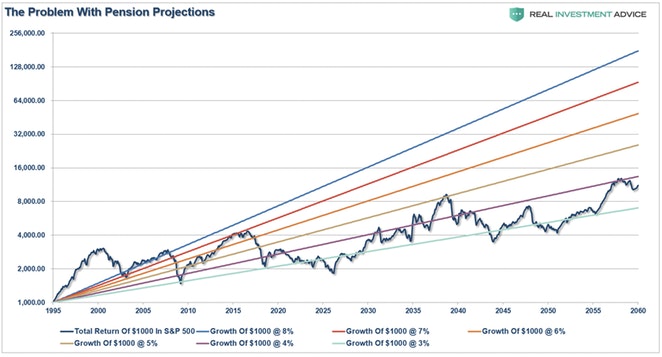

The chart below is the S&P 500 TOTAL return from 1995 to present. I have then projected for using variable rates of market returns with cycling bull and bear markets, out to 2060. I have then run projections of 8%, 7%, 6%, 5% and 4% average rates of return from 1995 out to 2060. (I have made some estimates for slightly lower forward returns due to demographic issues).

![]()

Given real-world return assumptions, pension funds SHOULD lower their return estimates to roughly 3-4% in order to potentially meet future obligations and maintain some solvency.

Related: HYLD: An Outperforming High Yield Bond ETF

They won’t make such reforms because “plan participants” won’t let them. Why? Because:

It would require a 40% increase in contributions by plan participants which they simply can not afford.

Given that many plan participants will retire LONG before 2060 there simply isn’t enough time to solve the issues, and;the next bear market, as shown, will devastate the plans abilities to meet future obligations without massive reforms immediately.

We Are Out Of Time

Currently, 75.4 million Baby Boomers in America—about 26% of the U.S. population—have reached or will reach retirement age between 2011 and 2030. And many of them are public-sector employees.

In a 2015 study of public-sector organizations, nearly half of the responding organizations stated that they could lose 20% or more of their employees to retirement within the next five years. Local governments are particularly vulnerable: a full 37% of local-government employees were at least 50 years of age in 2015.

It is no surprise that public pension funds are completely overwhelmed, but they still have not come to the realization that markets do not compound at an annual return of 8% annually. This has led to a continued degradation of funding levels as liabilities continue to pile up.

The next crisis won’t be secluded to just sub-prime auto loans, student loans, and commercial real estate. It will be fueled by the “run on pensions” when “fear” prevails benefits will be lost entirely.

It’s an unsolvable problem. It will happen. And it will devastate many Americans. It is just a function of time.

2050 Gap Will Never Happen

We will never hit a pension gap of $400 trillion. Instead, one of the following will happen.

Plans will have long ago defaulted or gone bankrupt with benefits slashed. Michigan paved the way for this option. Millennials, who will undoubtedly be fed up with boomer benefits will vote for massive changes. For some states, this will require constitutional changes.

At the national level, we may see revised bankruptcy laws superseding state provisions.

Some may suggest a pension bailout by the Fed. I doubt that because the numbers involved would destroy the dollar. The Fed exists to bail out banks, not pensioners.

Congress could bail out the pensions, but once millennials and younger generations are firmly in control, they will not vote to screw themselves even more.By one means or another, baby boomers counting on public pensions will not get what they mistakenly believe they have coming.

This article has republished with permission from Mish Talk .