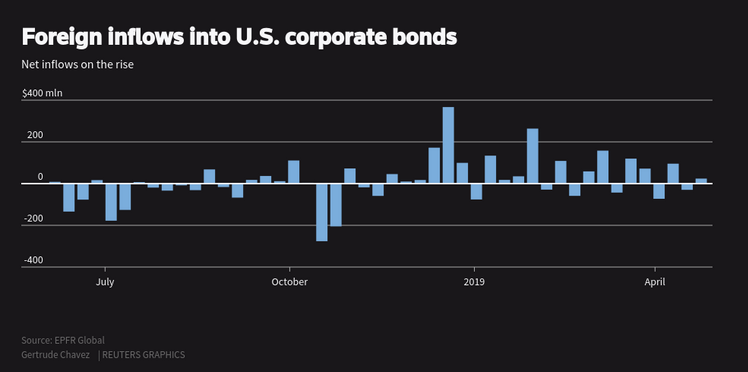

U.S. investors may seek opportunities overseas for diversification and bonds for safe-haven alternatives, but as for foreign investors, they also prefer the latter when it comes to appeasing their appetite for yield, especially the corporate variety.

It’s difficult to blame them, particularly when the U.S. investment grade sector is returning 5.6 percent so far this year following a 2.2 percent loss in 2018. As for riskier debt, high yield is returning 8.3 percent after a loss of 2.3 percent in 2018, to the Bank of America corporate bond indexes.

In addition, 2019 is certainly seeing a more cautious Federal Reserve when juxtaposed with the rate-hiking machine it was in 2018. Rather than trying to pinpoint a sustained inflation target, a more adaptable Fed could certainly be beneficial for the global market and put risk assets back on the proverbial map.

Thus far, that has been the case with fixed income, particularly with the rise in interest for high yield.

“The much more benign outlook for interest rates has contributed to very sizable returns on fixed income including corporate bonds in the first part of the year,” said Hans Mikkelsen, head of high grade credit strategy at Bank of America Merrill Lynch in New York.

Equities have been getting roiled by U.S.-China trade deal uncertainties as both nations may have reached an impasse in getting a permanent deal in place. In the meantime, foreign investors are diving into the safe confines of U.S. bonds.

“The U.S. has been the shining star in the global economy and this is where you’re seeing very strong growth and very strong fiscal support over the last year,” said Robert Brauns, portfolio manager for multi-strategy fixed income at BNP Paribas Asset Management in New York.

“I think that has enticed investors to put some more money to work in the U.S.,” he added.

China responded to the latest tariff threats by U.S. President Donald Trump by promising to take “necessary countermeasures” if the Trump administration follows through on its threat to increase tariffs on Chinese goods. After the tariff increase went into effect last Friday, China’s Commerce Ministry said that it will make retaliatory moves if U.S. tariffs on $200 billion of Chinese goods are increased to 25% from 10% as promised by the Trump administration.

“The escalation of trade friction is not in the interests of the people of the two countries and the people of the world,” the ministry said. “The Chinese side deeply regrets that if the US tariff measures are implemented, China will have to take necessary countermeasures.”

For more market trends, visit ETF Trends.