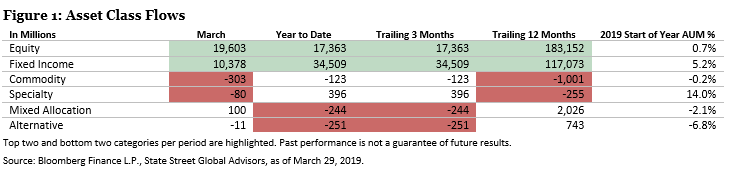

It’s no doubt that the volatility-laden fourth quarter of 2018 spurred an investor move to bonds, but that trend persisted in the first quarter of 2019 with $34.5 billion going into fixed income exchange-traded funds (ETFs), according to a US-Listed Flash Flows Report from State Street Global Advisors.

It provided more evidence that investors are picking themselves up in 2019 after a tumultuous way to end 2018. The Dow Jones Industrial Average fell 5.6 percent, while the S&P 500 was down 6.2 percent and the Nasdaq Composite declined 4 percent.

2018 marked the worst year for stocks since 2008 and only the second year the Dow and S&P 500 fell in the past decade. In 2019, investors are no doubt reassessing their strategies for how to distribute their capital through the rest of the year.

That said, more investors began to add fixed income products to their portfolios.

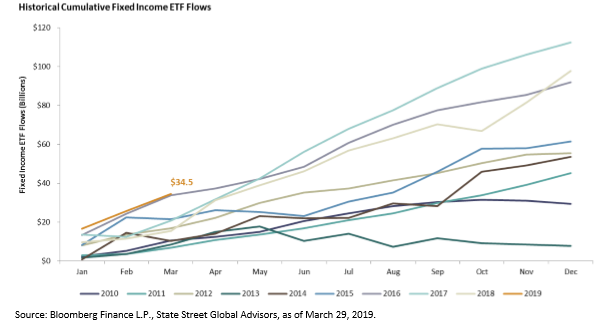

“While equity funds took in the most flows last month, bond funds are now breaking records and making headlines,” wrote Matt Bartolini, Head of SPDR Americas Research at State Street Global Advisors. “Fixed income ETFs have taken in $34.5 billion to start the year, the highest flow total ever for a first quarter, narrowly beating out the hot start to 2016.

“The $34.5 billion represents an increase of 5.2% of fixed income ETFs start-of-year assets. If bond funds are able to maintain this pace, it would lead to over $130 billion of fund flows–a figure that would represent new all-time record and likely push total assets over $800 billion for the first time.”

As opposed to simply adding a broad-based fund like the iShares Core US Aggregate Bond ETF (NYSEArca: AGG), it will take more of a strategic bent, such as looking into actively-managed funds or other corners of the bond market like municipal debt. This is especially so since the Federal Reserve said during its fourth and final rate hike in December 2018 that it will do more reassessing–the central bank already lowered its forecast to no rate hikes in 2019 as opposed to the initial two forecasted.

As opposed to simply adding a broad-based fund like the iShares Core US Aggregate Bond ETF (NYSEArca: AGG), it will take more of a strategic bent, such as looking into actively-managed funds or other corners of the bond market like municipal debt. This is especially so since the Federal Reserve said during its fourth and final rate hike in December 2018 that it will do more reassessing–the central bank already lowered its forecast to no rate hikes in 2019 as opposed to the initial two forecasted.

Where are the opportunities in fixed income at the moment? Bartolini identified some notable trends.

“Within fixed income, they’re (investors) are actually buying high yield, investment-grade quality bonds,” Bartolini told ETF Trends. “What they’re doing essentially is going overweight fixed income, overweight credit and basically changing their risk within a portfolio–trading equity risk for credit risk, and credit has similar equity returns, but with less volatility.”

The chart below represents the yearly cumulative flows the past eight years with the orange line showing the first quarter’s run up to record-reaching flows for fixed income ETFs. While Bartolini notes that while this represents a record in terms of sheer dollar amount for fixed income ETFs, one has to consider their percentage of total assets at the start of 2019.

“While this is a record start in terms of dollar figures, it is not when considering the flows as a percent of start-of-year assets,” said Bartolini. “That record is still held by the year 2016, when the $33 billion of flows represented a 9.5% increase as investors sought shelter from a storm of volatility when the S&P 500 Index fell 10% through February.”

“While this is a record start in terms of dollar figures, it is not when considering the flows as a percent of start-of-year assets,” said Bartolini. “That record is still held by the year 2016, when the $33 billion of flows represented a 9.5% increase as investors sought shelter from a storm of volatility when the S&P 500 Index fell 10% through February.”

Highlights of the latest State Street report:

- Posting their best first quarter performance since 1998, global equities are now just 3% below their all-time high

- Investors favored developed over emerging markets in March, reversing the year-to-date equity trend

- Sector investors still aren’t buying this rally; sectors had net outflows – for the fifth month of the last six

- Bond ETFs, led by credit funds, took in a record flow amount for a first quarter with +$34 billion

For more market trends, visit ETF Trends and to access up-to-date data on ETFs, visit ETFdb.com.