The all-powerful FOMC meets and will provide us with mostly conjecture as to their continued waffle of a monetary policy. It was just a few months ago the FOMC was calling for 4 rate hikes in 2019, my how things have changed, we will be lucky to get one.

The combination of balance sheet reduction and lack of global real sustainable growth has led the FOMC to produce nothing short of one’s tail between the legs. Defeated and dejected and spit out of the mouth of the even more powerful global bond markets, who have most certainly called the Fed’s bluff on their rate hikes. What do we mean?

Well the yield curves have steepened and 10yr yields have consistently tested the 2.52% area. For all our long-time readers, you know how important this level is for us, being that the Fed Funds upper limit rests at 2.50% a clear inversion of the Fed Funds / 10yr would (we mean will) usher in certain pain for the overall equity market tone. Why is this level important? Because the free investment rate will be below the cost of funds and thus this inversion has a negative future cash flow effect and when we discount future cash flows, we must at times discount our expected returns. Now think of the massive amounts of leverage in the system and think gee how much real capital underpins these assets??? Not much, that’s for darn sure.

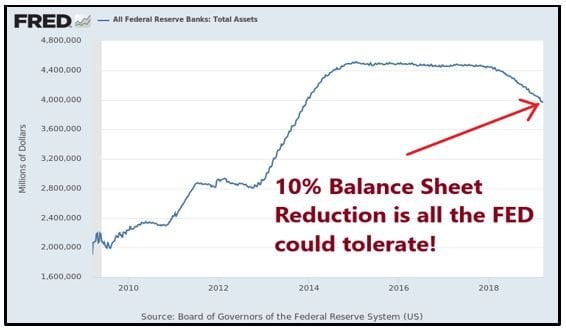

The absolute about face from the FED flies in the face of any economic fundamental financial principal. Basically, the FED has decided to target asset prices, which from a sound Austrian Economic level…should be illegal. Let’s just call it what it really is, counterfeiting. When you have the authority to print money and buy private assets, well just exactly pray tell how Joe Blow public can compete? They can’t and thus the weak-kneed FED has decided enough of the rate hikes, the market can’t take it, nor can they take the massive and we mean massive (#joke) central bank balance sheet reductions! Please stop, Mr. Market can’t take this whopping 10% balance sheet reduction:

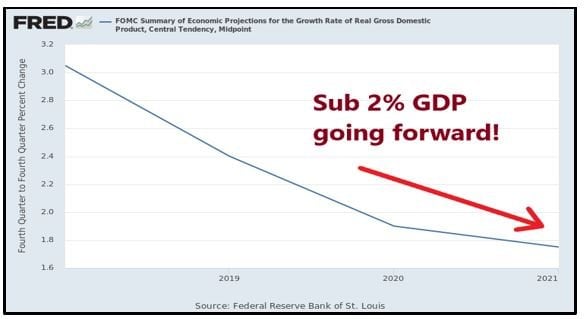

We tend to think that public has been sold down the road of false promise, we have mounting debt piles both from the public balance sheet and from the corporate balance sheet and how exactly are we going to grow ourselves out of this mess? Certainly not with this next chart, showing a clear subpar growth projection out of the FOMC themselves:

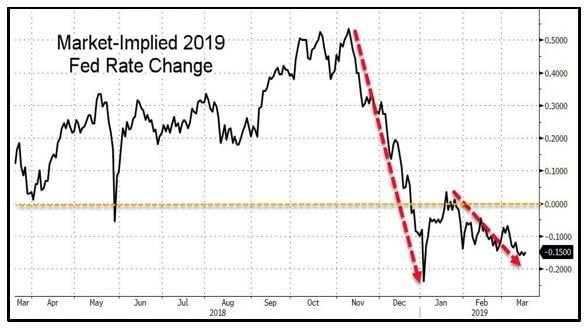

So, with the FED put firmly in their place by the true almighty, the global bond markets, all those future rate hike expectations have been vaporized:

All it took was for the equity markets to take it on the chin in December, but apparently the markets have shrugged the FED off and said, we know your playbook, we know you have our backs, we know the FED Put is alive and well. In fact, it might be as potent as ever as the FED and the global central banks don’t even hide it anymore, they do it all in plain sight! All those CNBC deniers, the Steve loser Liesman’s that for year’s denied the central banks real mandate…paging Presidents Working Group…now it’s much simpler just an easy call to the Citadel trading desk and lift off…

So, what does it mean for the markets tomorrow? We expect the FED to act a bit too big for its britches, act as if it has the power to raise rates, why? Because that is all they have left is empty words, the cat is out of the bag and the reality is it has been for a decade and will continue to be:

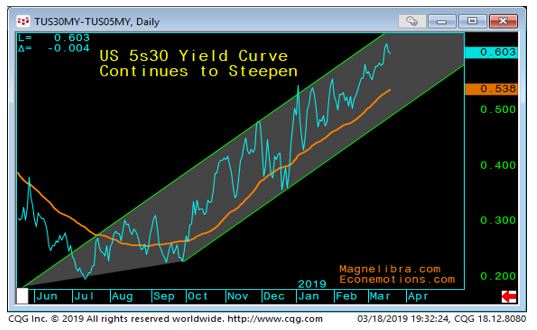

First up let’s look at the US Govt 5s30 Yield Curve steepening, tripling since July from 20bp to over 60bp today:

The next chart shows just how important 2.52% is, we suspect the FED will try to up the ante on the dot plot chart tomorrow and claim some hawkish tones. This may cause yields to rise a bit, but we suspect 2.52% will be taken out in short order here:

The SP500 has broken above that important 2811 and will continue to play a bullish theme if it stays above, 2830 seems key short term: