The Nasdaq has a hugely obvious 7354 resistance/support we have seen major pullbacks in the past from this kind of Fib set up, so be on the look out of a reaction here and possible trend activation:

The Russell 2K is being hampered by the 200pVwap but has seen a nice 26% run from the lows, but has been outpaced lately by the powerful Nasdaq run:

Oil has had a great run this year so far as well up some 37% from the lows, the only question is, we saw a decent run most of the year last year, to only have it wiped out in the last quarter:

Gold has been strong but has pulled back off the highs near $1350 and is holding above the $1281 level which we deem very big support and most likely the line in the sand for the bulls:

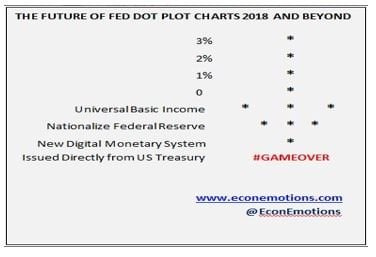

Well that’s it, with the FOMC up tomorrow and with the fact that the FED may be done raising rates for our lifetime, we can’t help ourselves and displaying our own proprietary Fed Dot Plot chart for your amusement:

If you enjoyed reading this, please subscribe to our Weekly Newletter: https://info.capitaltradinggroup.com/ctgs-weekly-unique-insights-newsletter-0-1

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

For more market trends, visit ETF Trends