“With unemployment low and expected to decline further, inflation close to our objective, and the risks to the outlook roughly balanced, the case for continued gradual increases in the federal funds rate is strong,” Powell said.

However, with a flattening Treasury yield curve that could invert–a precautionary sign that preceded the last two recessions, LaVorgna thinks the Fed’s next move should be the shuffle back (of rates) rather than the raise.

“If the Fed goes two more times this year … the yield curve inverts, certainly by early Q4,” said LaVorgna. “If that’s the case, you want to be on the lookout for recession as early as Q4 of 2019.”

Related: Central Banks Weigh In on Global Economy

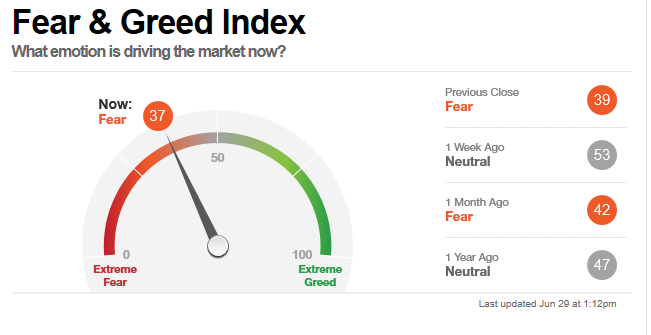

Consumer Sentiment Weaker, Fear Higher

The latest trade concerns may be weighing on the minds of consumers as sentiment was up just 0.2 percent from the previous month. Historically, sentiment remains high with the low unemployment rate and rising incomes, but the impact of the tariff battle between the United States, China and European Union is hampering CNNMoney’s Fear & Greed Index.

![]()

For more economic trends affecting the market, click here

For more economic trends affecting the market, click here