With the Federal Open Market Committee set to decide on interest rates later today at 2:00pm Eastern Time, a few broad-market ETFs are getting an early boost ahead of the decision.

As of 1:00pm Eastern Time, SPDR S&P 500 ETF (NYSEArca: SPY) is up 0.08%, Invesco QQQ Trust (NYSEArca: QQQ) is up 0.50% and iShares MSCI Emerging Markets ETF (NYSEArca: EEM) is up 0.24%.

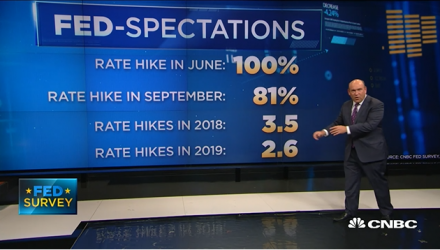

The general consensus across the markets point to rate hikes given the unemployment rate is at a low 3.8%, wages are rising and inflation is currently at a healthy level. This could explain the early rise in these broad-market ETFs as the predisposition toward rate hikes are already reflected in the current prices.

“Markets are currently pricing in a 46% chance of four rate hikes across the year, meaning traders are fairly equally divided. Yet given the backdrop of troubled global trade [relations], the Fed could be keen to hold off a little longer. Consumer price inflation might be at 2.8% but [the PCE price index], the Fed’s preferred measure of inflation, is still at just 1.8%, meaning time is still on the Fed’s side,” said Jasper Lawler, Head of Research at London Capital Group.