The adage “the more things change, the more things stay the same” could relate to the Federal Reserve’s 2018-19 interest rate policy–it kept changing (higher) in 2018 and now the capital markets expect them to stay unchanged through 2019.

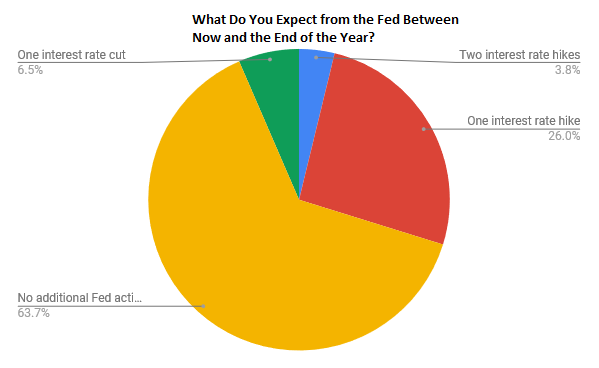

At the ETF Trends-ETFdb 2019 Virtual Summit, that’s exactly what the majority of attendees also think when asked whether they expect to see the central bank take more action on interest rates–upward (one rate hike or two), downward with a rate cut or none at all — 63.70 percent are expecting the latter.

The survey was presented on the Fixed Income Strategies for a Changing Debt World, which featured the following panel of experts:

- Jordan Farris, Managing Director, Head of ETF Product Development, Nuveen

- John Ecklund, Managing Director, Global Fixed Income, Currency & Commodities Group, J.P. Morgan Asset Management

- Tim Urbanowicz, Senior Fixed Income ETF Strategist, Invesco

The experts covered the potential headwinds facing the bond markets, such as inverted yield curves, BBB investment-grade bonds succumbing to junk status and slowing global growth.

Higher Quality and Short Duration

Getting broad-based bond exposure through funds like the iShares Core US Aggregate Bond ETF (NYSEArca: AGG), which tracks the investment results of the Bloomberg Barclays U.S. Aggregate Bond Index, might work for core bond exposure, but investing in the bond markets in 2019 will also require a more strategic tilt. The AGG gives bond investors general exposure to the fixed income markets, but there are times when current market conditions warrant a deconstruction of the AGG to extract maximum investor benefit.

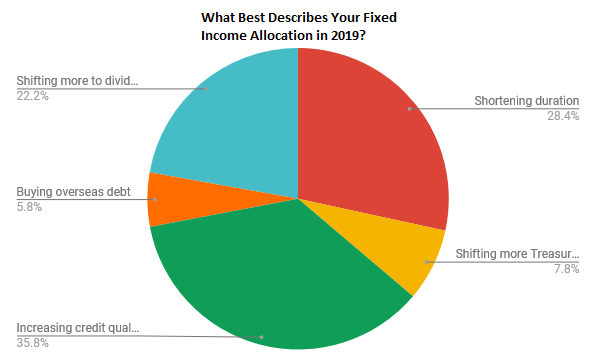

Where exactly were Virtual Summit attendees more apt to allocate their capital within the bond markets? The options presented were Shortening duration, shifting more Treasuries to corporate bonds, increasing credit quality, buying overseas debt, and shifting more to dividend-oriented stocks.

The survey revealed that investment-grade debt and short duration were the prime focus.

The end of 2018 also spurred a move to bonds as investors sought more safe-haven alternatives amid the volatility. One corner of the bond market that especially saw an influx of capital was short duration bonds.

While shorter durations still have a place in fixed income portfolios, there’s also a need for investment-grade debt issues–a plus during times of volatility. This also speaks to a move towards quality to not just in the equities space, but also in the fixed income space.

Where Are the Fixed Income Opportunities?

Part of the investor noise affecting the capital markets in 2018 was rising interest rates. The central bank didn’t show much dynamism in 2018 with respect to monetary policy, obstinately sticking with a rate-hiking measure with four increases in the federal funds rate.

That appears to have changed given the current economic landscape, and especially in the capital markets as Fed Chair Jerome Powell is now preaching patience and adaptability. So how do bond investors approach 2019?

From getting broad exposure, short duration and income via senior loans, the experts delved into opportunities investors can consider via ETFs despite a challenging 2019 ahead for the bond markets. It’s another reason to take advantage of the Virtual Summit to discover where the best alternatives are to deploy capital.

Missed the Virtual Summit? The on-demand version is available now: https://www.etftrends.com/virtual-summit.