Monday’s trading session saw the Dow Jones Industrial Average shed over 600 points, sparking a move into bonds for shaken investors.

It’s another reminder that bonds, despite the current low-yield environment, are good for more than just fixed income purposes. Safe haven government debt saw prices rise and yields fall as investors piled into Treasury notes to escape the equities sell-off.

“U.S. Treasury prices jumped and yields declined as investors rushed into the safety of U.S. government bonds amid a global sell-off in financial markets,” a CNBC report noted.

Investors could be caught up in the 24-hour news cycle, sparking fears of how the markets will react through the rest of the week. The Federal Reserve’s next moves on monetary policy will reveal themselves this week, particularly whether the central bank senses an overheating economy, causing it to scale back its economic stimulus measures.

“We are in an information vacuum at the moment,” said Jamie Cox, managing partner at Harris Financial Group. “Stalemates in Congress on the debt ceiling, worries on policy changes or mistakes in monetary policy, and a litany of proposed tax increases have dampened the mood for investors. When this occurs, corrections happen.”

A Pair of Bond Options

Investors can join the move into bonds with a pair of options from Vanguard. One ETF is the Vanguard Total Bond Market Index Fund ETF Shares (BND).

BND presents bond investors with an all-encompassing, aggregate solution to getting U.S. bond exposure. It’s an ideal solution for investors seeking to complement their equities exposure.

BND seeks the performance of Bloomberg U.S. Aggregate Float Adjusted Index. The Bloomberg U.S. Aggregate Float Adjusted Index represents a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, including government, corporate, and international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities, all with maturities of more than one year.

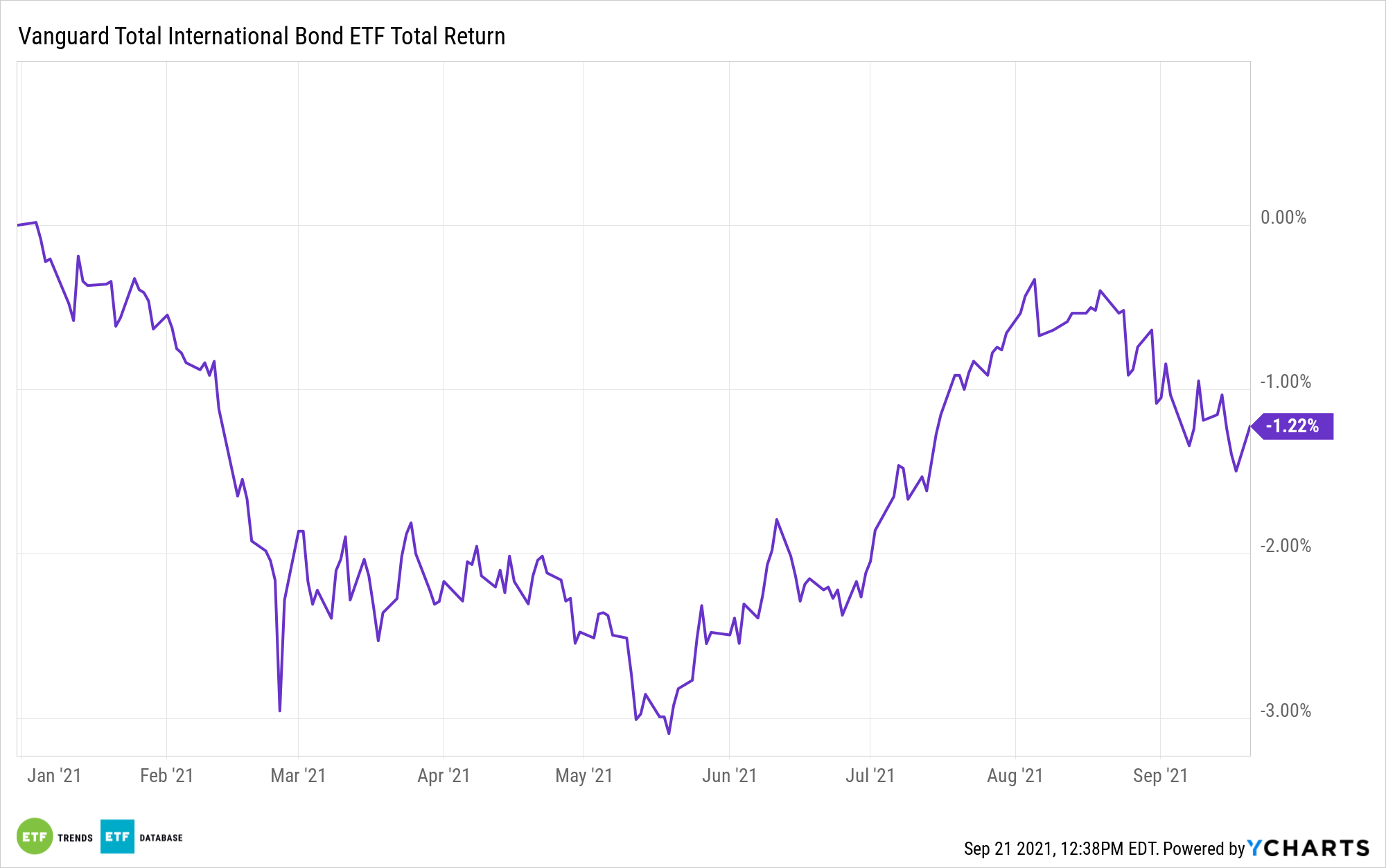

Another option is the Vanguard Total International Bond Index Fund ETF Shares (BNDX), which seeks to track the performance of a benchmark index that measures the investment return of non-U.S. dollar-denominated investment-grade bonds. International bonds can provide a diversification tool for fixed income investors looking to supplement their current core portfolio.

The ETF employs an indexing investment approach designed to track the performance of the Bloomberg Global Aggregate ex-USD Float Adjusted RIC Capped Index (USD Hedged), which provides a broad-based measure of the global, investment-grade, fixed-rate debt markets.

For more news, information, and strategy, visit the Fixed Income Channel.