Federal Reserve Chairman Jerome Powell gave the capital markets what they wanted to hear, which was leaving the door wide open for the possibility of interest rate cuts. For fixed income investors, a low-interest rate environment doesn’t bode well for high yield options, but one place they could look for is emerging markets debt.

2019 has thus far seen the reemergence of emerging markets, but while investors are sifting through the plethora of opportunities the EM space has to offer, it’s wise to not overlook the high yield corner of the bond markets. With fears of a global economic slowdown putting the clamps on higher rates, emerging markets debt could be the miracle elixir for high-yielding asset allocation.

“We’ve kind of been in a bit of a Goldilocks period for emerging markets, ” said Brett Diment, head of global emerging market debt at Aberdeen Standard Investments.

“Slower growth means lower interest rates in the developed markets,” he said. While growth in emerging markets is decent, inflation is coming down which could cause central banks to cut rates, Diment said.

Of course, there’s the U.S.-China trade impasse that could also be a major factor with respect to the performance of emerging markets. For fixed income investors looking for opportunities within the EM space, a resolution between the two largest economies on trade would be a welcome option.

“In the context of what hopefully will be some sort of a resolution between the U.S. and China, that’s a pretty good backdrop for emerging market fixed income,” Diment told CNBC’s “Street Signs. ”

An Emerging Markets High-Yield Option

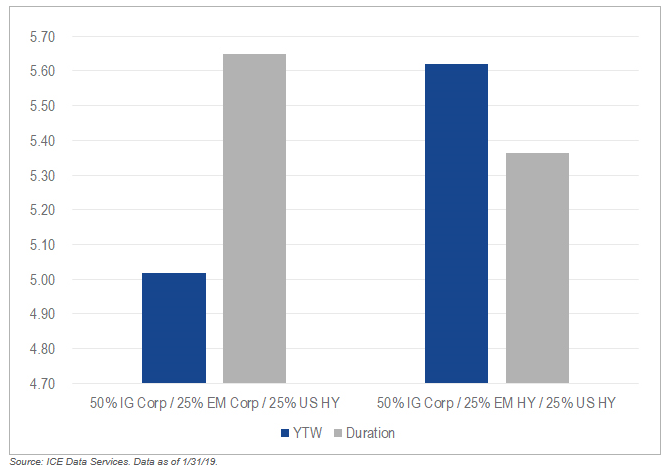

An option to consider in the EM high-yield bond market is the VanEck Vectors EM High Yield Bond ETF (NYSEArca: HYEM). HYEM seeks to replicate the ICE BofAML Diversified High Yield US Emerging Markets Corporate Plus Index, which is comprised of U.S. dollar denominated bonds issued by non-sovereign emerging market issuers that have a below investment grade rating and that are issued in the major domestic and Eurobond markets.

According to Morningstar performance numbers, HYEM has yielded a 9.56 percent return thus far in 2019. The fund gives investors the necessary diversification versus relegating a portfolio’s fixed income allocation to domestic investment-grade debt.

Domestically, seeking opportunities within high yield might seem like an arcane idea given the serendipitous bull run came to a crashing halt in the volatility-laden fourth quarter of 2018. The risk-on sentiment that fueled three-fourths of 2018 may have gone asunder as the massive sell-offs took place to end 2018.

For more market news, visit ETFTrends.com.

For more market news, visit ETFTrends.com.