The features of dividend-yielding equities are obvious with regard to the sustained income aspect, but more importantly, given the current market environment, they also possess risk management features that could mute the effects of volatility.

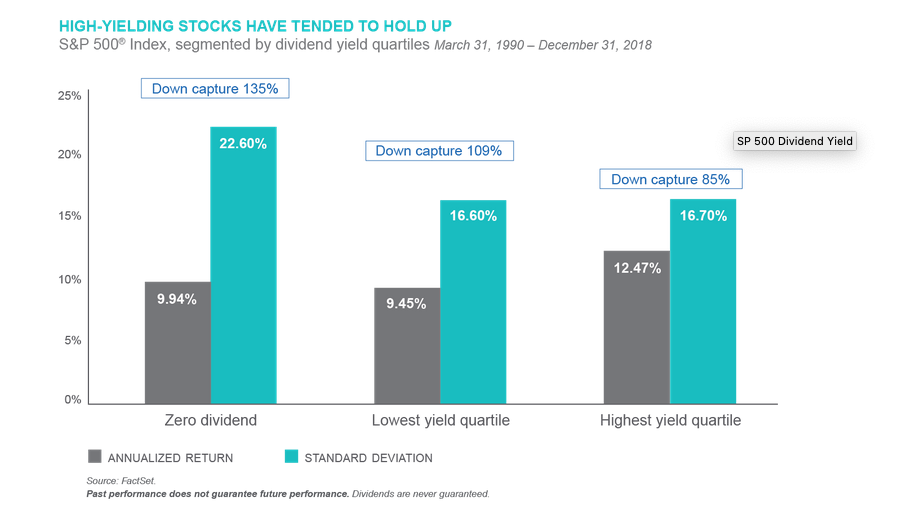

“The potential benefits have been well-documented–dividends have been a large contributor to long-term stock returns over time, and with interest rates poised to remain low equity dividends are likely to be an important part of that story,” wrote Victory Capital portfolio manager Dan Banaszak. “But perhaps even more important are the potential risk-managing attributes of higher dividend-paying stocks. This is illustrated by a substantially higher standard deviation of non-dividend paying stocks versus dividend payers. At the same time, the highest-yielding companies have outperformed those with zero dividend over the long term.”

Banaszak presented two takeaways:

- Scratch below the surface: “It’s not as simple as buying the highest-yielding company or finding those companies with the longest history of paying high dividends. After all, dividend yield is just a percentage—a function of stock price—so a company encountering trouble and a stock declining in price might still sport a very attractive yield. A rigid methodology that ignores fundamentals could include companies with artificially high dividends or even those precariously poised to reduce dividends. High yield by itself is not a reliable marker for a quality company.”

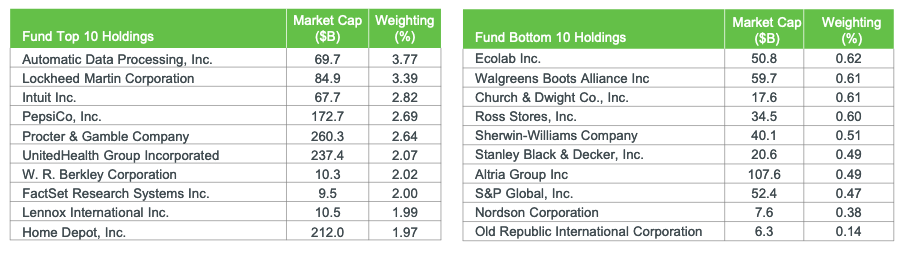

- Beware unintended consequences: “Building a portfolio of high-dividend stocks and weighting it based on market capitalization or dividend yield alone can lead to unintended consequences. Such strategies are likely to be concentrated in their top holdings or overweight in narrow swaths of the economy. Strategies that seek to limit extreme sector exposures and weight securities more evenly can be a more diversified way to access the potential benefits of a high-dividend approach.”

One ETF to consider is the VictoryShares Dividend Accelerator ETF (NasdaqGM: VSDA), which offers exposure to large-cap U.S. stocks, that feature not only a history of increasing dividends, but which also possess the highest probability of future dividend growth. It seeks to provide exposure to dividend growth, rather than yielding, offering a potential diversification benefit to high dividend yielding alternatives, particularly in a rising rate environment.

The fund provides investors with:

- potentially higher income through the sustainability of future dividend growth.

- a further layer of risk awareness by beginning with a broad investible universe and investing in high quality companies with stable earnings’ patterns.

The fund’s holdings as of March 31:

For more market trends, visit ETF Trends.