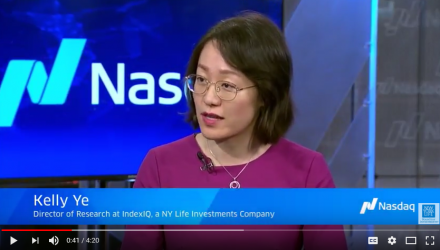

Kelly Ye, Director of Research at IndexIQ–a New York Life Investments Company that fancies itself on staying at the cutting edge of investment solutions, spoke with TradeTalks to discuss her company’s investment strategies and products, such as smart beta ETFs. Per the company website, IndexIQ is built “upon cutting-edge academic research, we take indexing to the next level by combining the best attributes of both passive and active investing, and make strategies available to investors in low cost, liquid, and transparent products.”

Related: Smart Beta ETFs: What Are They? How Do They Work?

Ye stated that the fixed income arena does not have to be bound to hard and fast rules for management, and that there is always room for innovation, particularly when it comes to developing investment products that are cost-effective and accessible to all types of investors–one of the core objectives at IndexIQ.

“Fixed income is an area dominated by active managers because of its complexity and liquidity,” said Ye. “But it doesn’t mean that a rules-based quantitative process cannot add value. In fact, I’ve been living and breathing fixed income investing for over a decade now and have really witnessed how a data model driven process can add value. ”

Click below to watch the full interview:

For more fixed income developments, visit the Fixed Income Channel.