Investor demand for taxable-bond funds continue to grow, according to the latest Morningstar Direct Fund Flows Commentary. Taxable-bond funds saw an influx of $42.5 billion during the month of April, which represented the second-best month over the past three years and the best since January 2018.

What’s driving this demand? According to the report, an aging investor population could be why.

“Many attribute these flow trends to demographics as aging baby boomers cut their equity holdings in favor of more-conservative bond funds,” the report said.

Specifically within the fixed income space, the majority of the capital went to intermediate-term bond funds. However, there was another interesting statistic to note.

“The bulk of taxable-bond flows went to intermediate-term bond funds, but there was an interesting bifurcation in April as the old intermediate-term bond Morningstar Category was retired and two new related Morningstar Categories were introduced: intermediate core bond and intermediate core-plus bond,” the report noted.

This move also translated into a preference for investment-grade debt.

“As you might guess from the name, intermediate core bond funds tend to invest in investment-grade bonds and are conventional in their approach,” the report said. “Funds in the intermediate core-plus bond category tend to have more-flexible mandates and take on more credit risk. In April, intermediate core bond flows were much greater with $20.5 billion in inflows versus $8.1 billion for core-plus.”

There was also a passive versus active story within the fixed income fund space. Passive funds took in $18.0 billion of the $20.5 billion collected by intermediate core bond funds, while active intermediate core-plus bond funds took $8.0 billion of the $8.1 billion collected overall.

Related: U.S. Stock ETFs Stumble as Trump Postpones Car Tariffs

Other Notable Trends

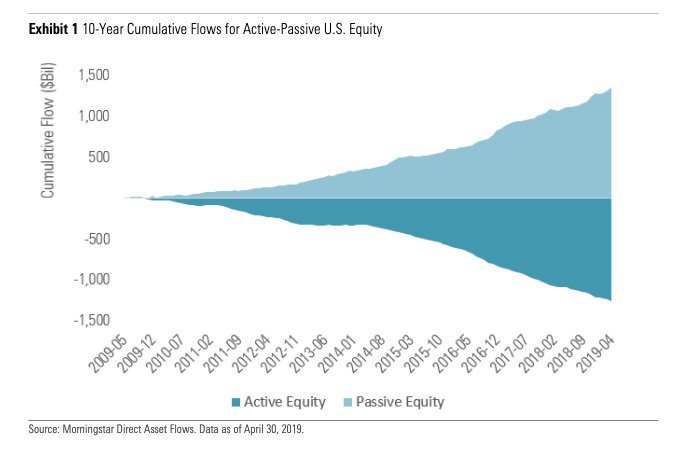

According to the report, capital inflows into passive equity funds grew their assets under management to $4.305 trillion by the end of the month, almost matching the $4.311 trillion in assets for active equity funds. Passive funds can thank an influx of $39 billion in inflows for this recent milestone.

Those April inflows could certainly spill over into May, which could put passive funds over active funds in terms of total assets compiled.

“Passive U.S. equity funds closed the gap with more than $39 billion in April inflows, versus more than $22 billion in outflows for their active counterparts,” the report highlighted “In market share terms (for open-end and exchange-traded fundscombined), active U.S. equity funds had 50.04% market share versus passive U.S. equity funds’ 49.96%. The May numbers will almost certainly show passive U.S. equity funds’ total assets eclipsing active funds.”

For more market trends, visit ETF Trends.

For more market trends, visit ETF Trends.