The idea of purchasing stocks that are inexpensive relative to their peers, or to their intrinsic value, can make value investing an attractive investment strategy.

After all, value has a well-earned reputation for being a rewarded factor, with famous investors like Benjamin Graham and Warren Buffet known for their value-based investment approaches. Value is also grounded in academic research. The groundbreaking Fama-French Three Factor Model incorporates value, along with the size and market factors, to help portfolio managers improve the security evaluation process.

What is a value trap?

While value can be an appealing investment strategy, identifying value opportunities is not as easy as it might appear. One of the drawbacks of value investing is the so-called “value trap.” A value trap occurs when a stock appears cheap, but is trading at low multiples due to underlying problems with the stock’s issuer. In other words, the stock is cheap for a reason and could trade even lower in the future. Changing industry conditions, secular shifts in technology, and management miscalculations can lead to value traps. Further, some valuation measures may be backward-looking when the market is pricing the future.

Value traps are real. Let’s take a look at two examples:

Value trap: Target

![]()

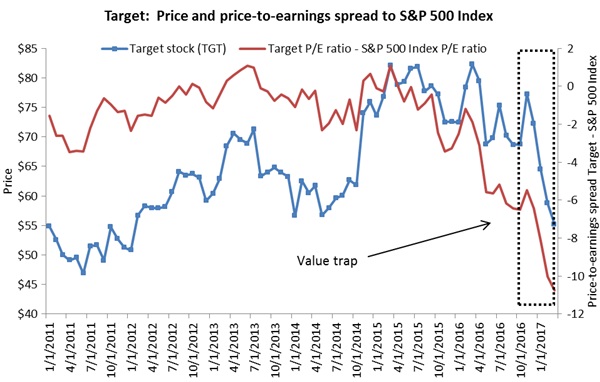

With only a few exceptions, between January 2011 and February 2016, Target’s price-to-earnings (P/E) ratio ranged within two points of the P/E ratio of the S&P 500 Index. However, in the spring of 2016, Target’s P/E ratio started moving lower, with its ratio spread to the S&P 500 Index widening to 6.5 by October 2016. Judging by its discounted P/E ratio, Target stock appeared inexpensive — a “value” to the broader market. At the close of October 2016, Target shares were priced at $68.73. Despite this discounted P/E ratio, however, Target’s stock went on to fall an additional 20% to $55.19 by March 2017. By contrast, the S&P 500 Index rose 11.1% over this same period, leading to a yawning P/E discount of 10.77.

In retrospect, Target’s valuation compression appeared linked to competitive pressures, a long-term trend toward online shopping, and changing consumer preferences and buying habits. Whatever the reason, Target’s stock price decline in the face of a low P/E ratio illustrates how difficult and risky ascertaining real value can be.

Value trap: The energy sector

![]()

Source: Bloomberg L.P., as of March 31, 2017

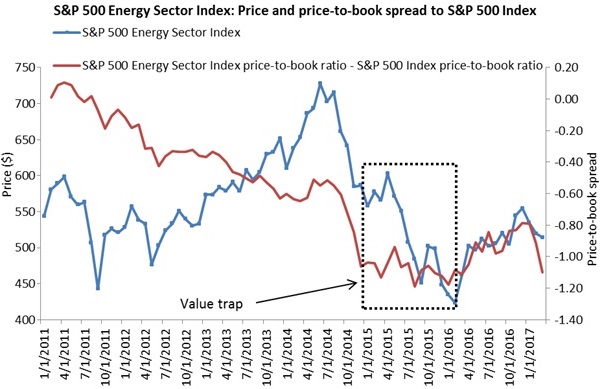

Another interesting case of a value trap can be found in the energy sector. (Given the high volatility of energy P/E ratios, I use price-to-book ratios in this example.) On a price-to-book basis, the spread between the S&P 500 Index and the S&P 500 Energy Index went from 0.10 in April 2011 to -1.04 by the end of January 2015.

Despite these low valuations, the price of the S&P 500 Energy Index retreated another 24% over the ensuing 12 months. So, even though the energy sector had become more attractively priced, energy prices continued to drop — again highlighting the difficulty in discerning value. By contrast, the S&P 500 Index declined only 3.1% across this same period.