Bond exchange traded funds strengthened on Thursday with yields falling off as initial jobless claims dipped to a new coronavirus pandemic-era low.

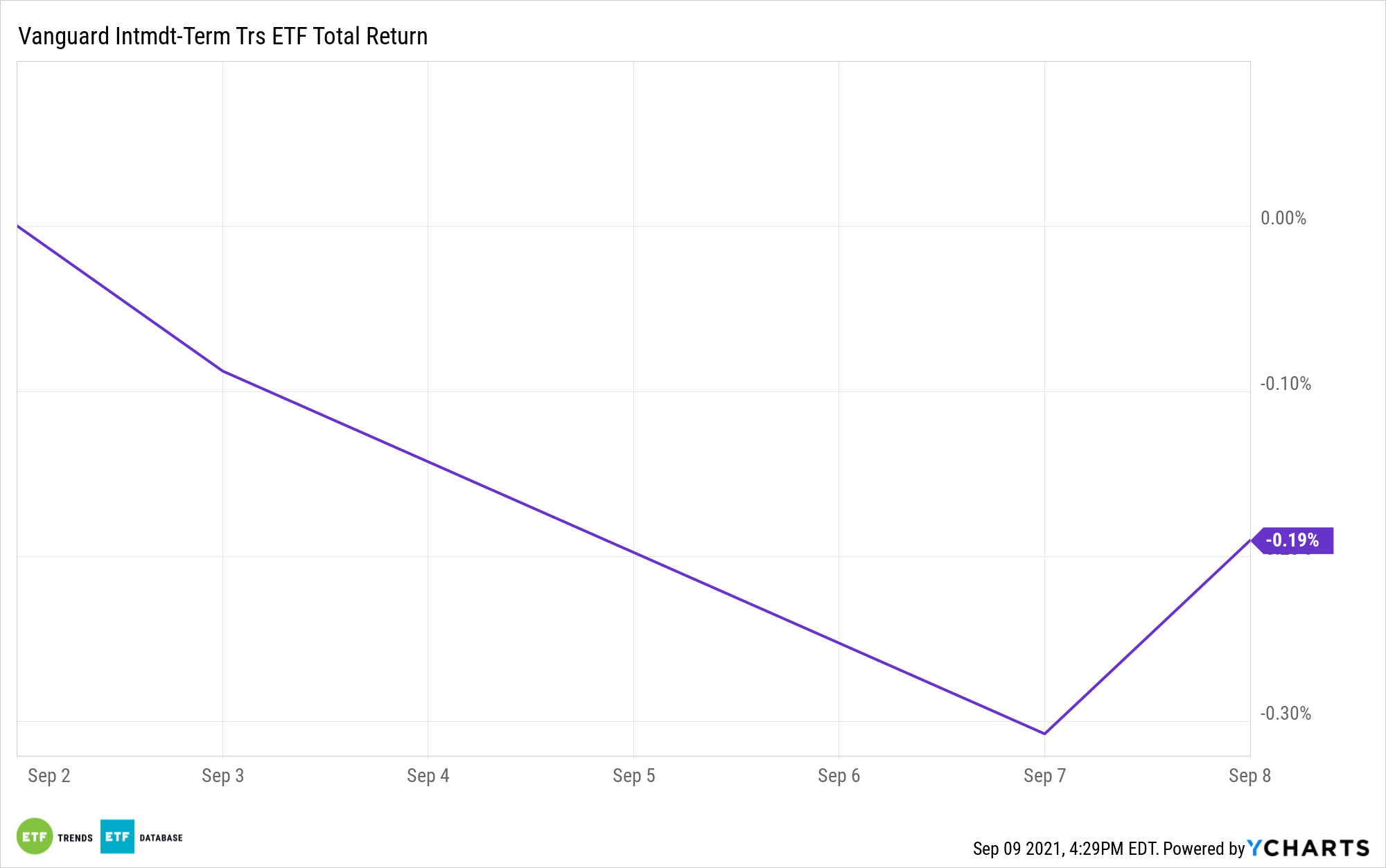

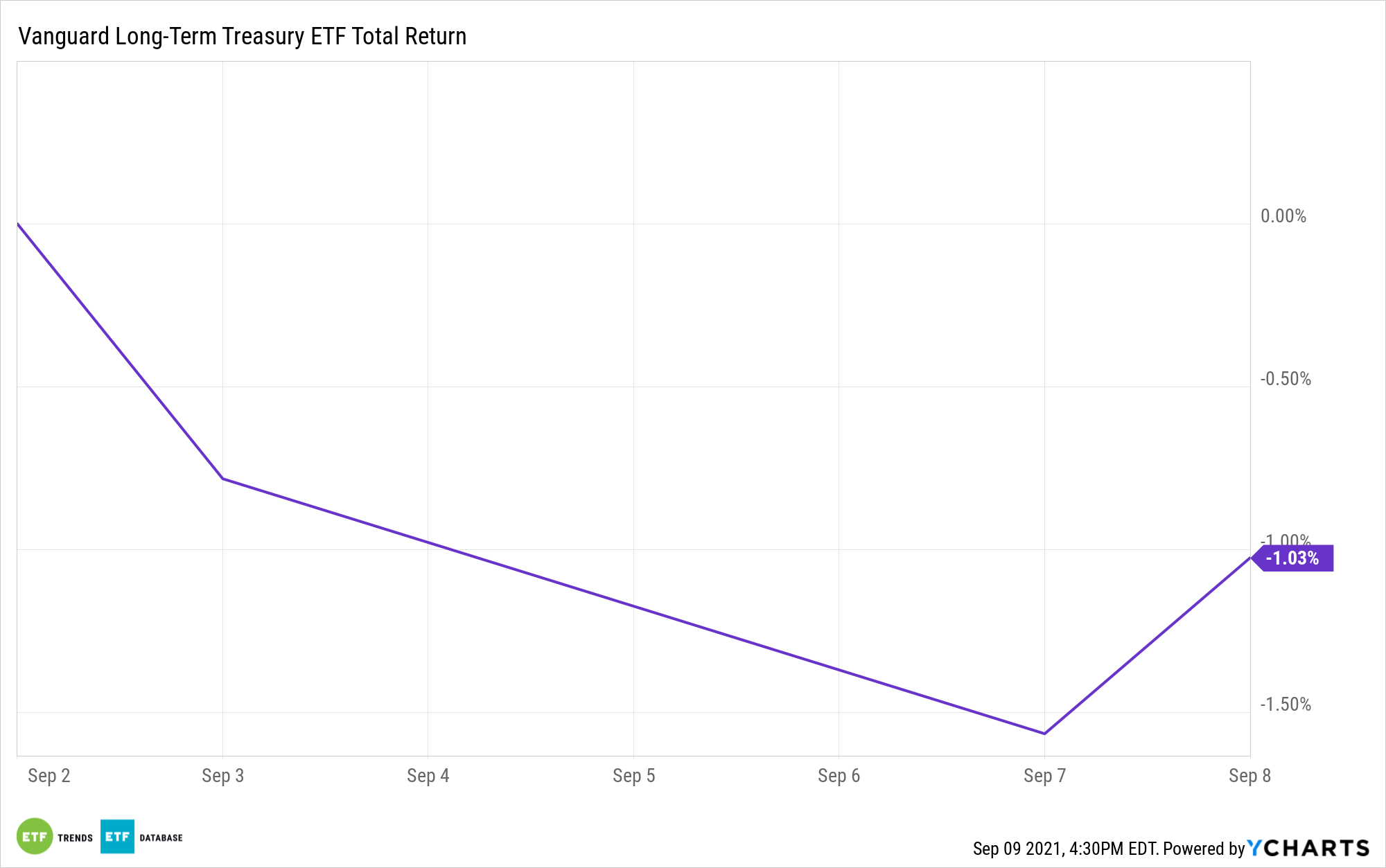

On Thursday, the Vanguard Intermediate-Term Treasury Index Fund ETF Shares (VGIT) was up 0.1%, and the Vanguard Long-Term Treasury Index Fund ETF Shares (VGLT) rose 1.1%. Meanwhile, yields on benchmark 10-year Treasury notes fell to 1.299%, and yields on 30-year Treasuries dropped to 1.897%. Bond prices and yields have an inverse relationship.

The number of jobless claims filed for the week that ended September 4 declined to 310,00, compared to economists’ expectations of 335,000 and the previous week’s 340,000.

Market observers were concerned about the ongoing bully market run that has pushed up valuations and lifted U.S. benchmarks to all-time highs.

“We have been among the voices saying…we are overdue for a correction,” Lauren Goodwin, economist and portfolio strategist at New York Life Investments, told the Wall Street Journal. However, Goodwin also asked, “what choices do investors have? Is there an alternative to equities when rates are so low and [forecasts show]the economy is still growing?”

Investors are now watching out for the Federal Reserve policy changes as the central bank looks to taper its bond purchasing program.

Meanwhile, rising infection rates of the COVID-19 Delta variant continues to weigh on the global growth outlook.

“We’re slightly more cautious,” Charles Hepworth, an investment director at GAM Investments, told the WSJ. “It does feel that people are getting a bit freaked out by valuations. The Delta variant transmission is a threat for global growth. If you get tapering too soon, that risks derailing the recovery.”

For more news, information, and strategy, visit the Fixed Income Channel.