As volatility seen has been racking the capital markets as of late, it has spurred activity in the bond markets, but BBB bonds, the lowest of investment-grade bonds, is one looming risk that could put the use of strategic fixed income funds in focus.

BBB bonds comprise almost 50% of the $5.8 trillion investment-grade bond market and a lack of liquidity could leave BBB bond investors holding the debt as it toes the line between investment grade and junk bond status–the worry, of course, being that it may eventually fall into the category of the latter.

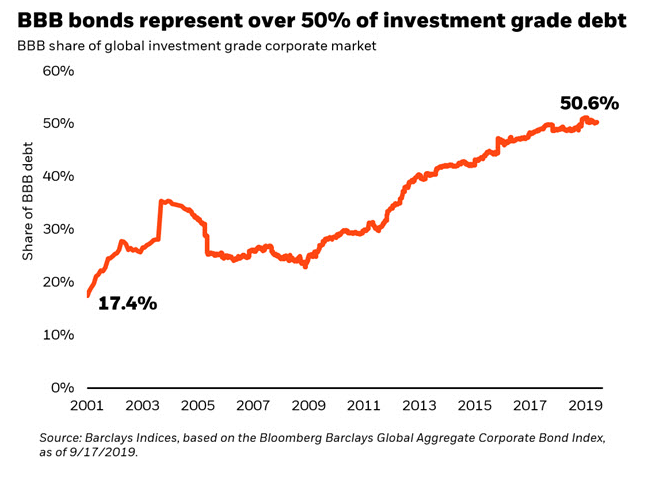

“Over the past decade, the investment-grade corporate bond market has grown as issuers have taken advantage of rock-bottom interest rates and increased demand from yield-starved investors,” wrote Karen Schenone, Fixed Income Strategist at BlackRock. “Today, the BBB-rated segment now makes up over 50% of the investment grade market versus only 17% in 2001. Over the past decade, U.S.-related BBB corporate debt has grown 2.2x to $2.5 trillion, representing $1.2 trillion of net new issuance and $745 billion of downgrades from a higher credit quality.”

How does an exchange-traded fund (ETF) address this forthcoming issue in investment-grade debt? One way is to target these risky BBB bonds and take the necessary action to remove the debt issue.

“Most investment grade bond ETFs seek to track an index from providers such as Bloomberg Barclays, ICE or Markit iBoxx,” Schenone wrote. “These providers determine a bond’s rating by using a blend of ratings from Moody’s, S&P and Fitch. Typically, if a bond gets downgraded by multiple rating agencies to BB+/Ba1 or below, then it will be considered high yield or junk, and the index will remove it at the end of that month.”

“The ETF’s portfolio manager will also seek to remove the bond from the portfolio and obtain best execution for the fund,” she added. “The portfolio manager can choose when to trade the bond and they are not forced to trade on month end. But they will remove the bond so over time an investment grade fund will remain that way.”

Schenone cited the following three funds as ETF strategies to consider:

- Avoid BBB-rated corporate bonds with iShares Aaa – A Rated Corporate Bond ETF (NYSEArca: QLTA). QLTA holds only AAA-A corporate bonds.

- Seek higher-quality investment-grade bonds with iShares Edge Investment Grade Enhanced Bond ETF (BATS: IGEB).

- Seek growth opportunity from a potential fallen angels premium with iShares Fallen Angels USD Bond ETF (NasdaqGS: FALN).

For more market trends, visit ETF Trends.